Statistics | Autoregressive Distributed Lag Model | Trading Strategies | Backtesting

This project was completed as part of the Statistics Module at SMU based on the Introduction to Econometrics, Global 4th Edition (2020) textbook. The course covered different ways of modelling and determining the fit of models based purely on statistics and gave me a deep understanding of the roots and concepts behind which current machine learning models were built upon. In terms of value, it develops a workflow for quickly determining the profitability of simple trading strategies through both the engineering of the data and backtesting of results.

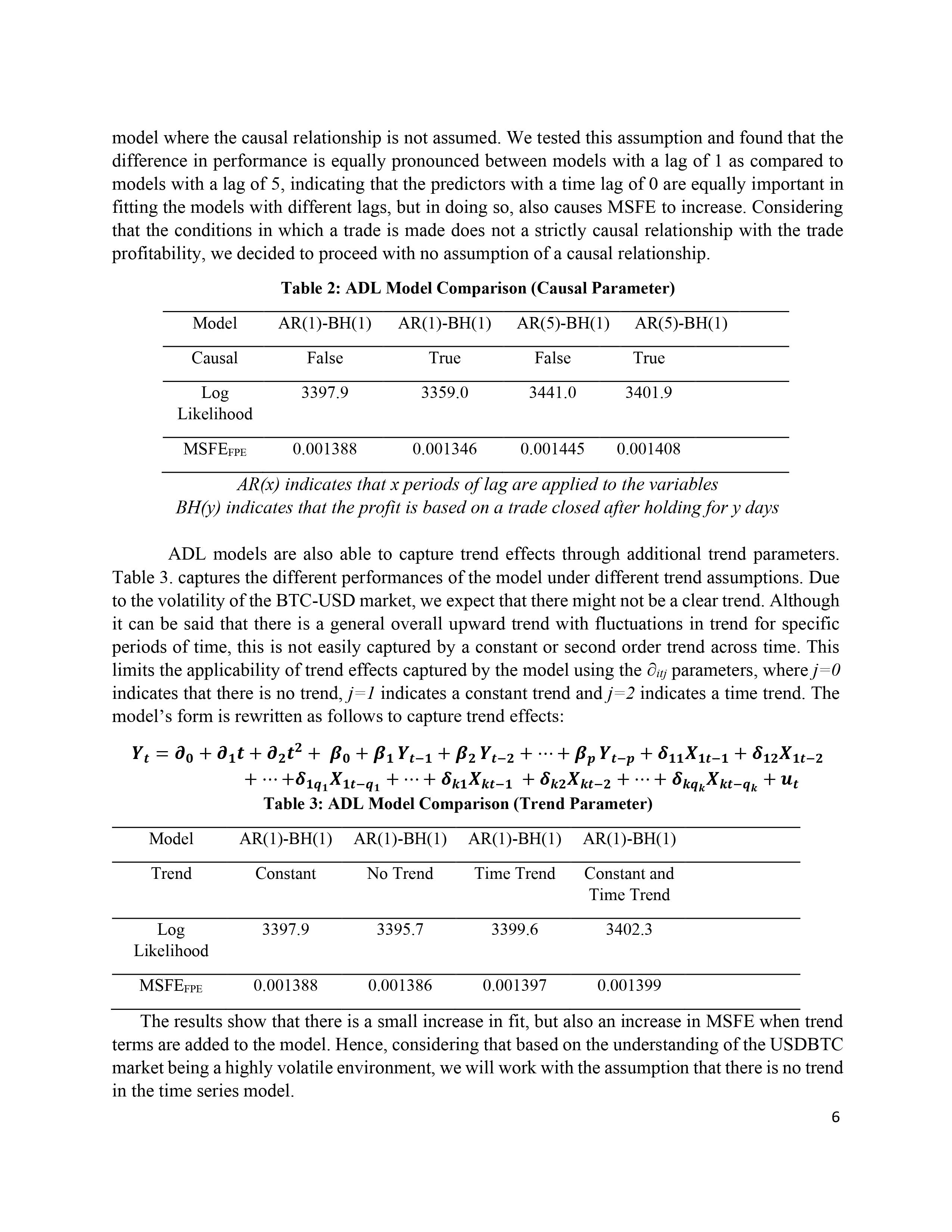

From the perspective of someone who has worked with multiple machine learning models before this module, I found that the statistical method of developing models was often more tedious in both setting up the data and applying the correct model for the specific context. However the major advantage came in the form of interpretability of the model's fit (especially for simpler models like the Ordinary Least Squares Regression Models). The array of model parameters that are generated after the fit quantifies how well a model fits the data from different angles (error, mean, variance, lags) which are invaluable for interpretation and understanding the limitations of the model. This is (currently) often lacking for machine learning models.

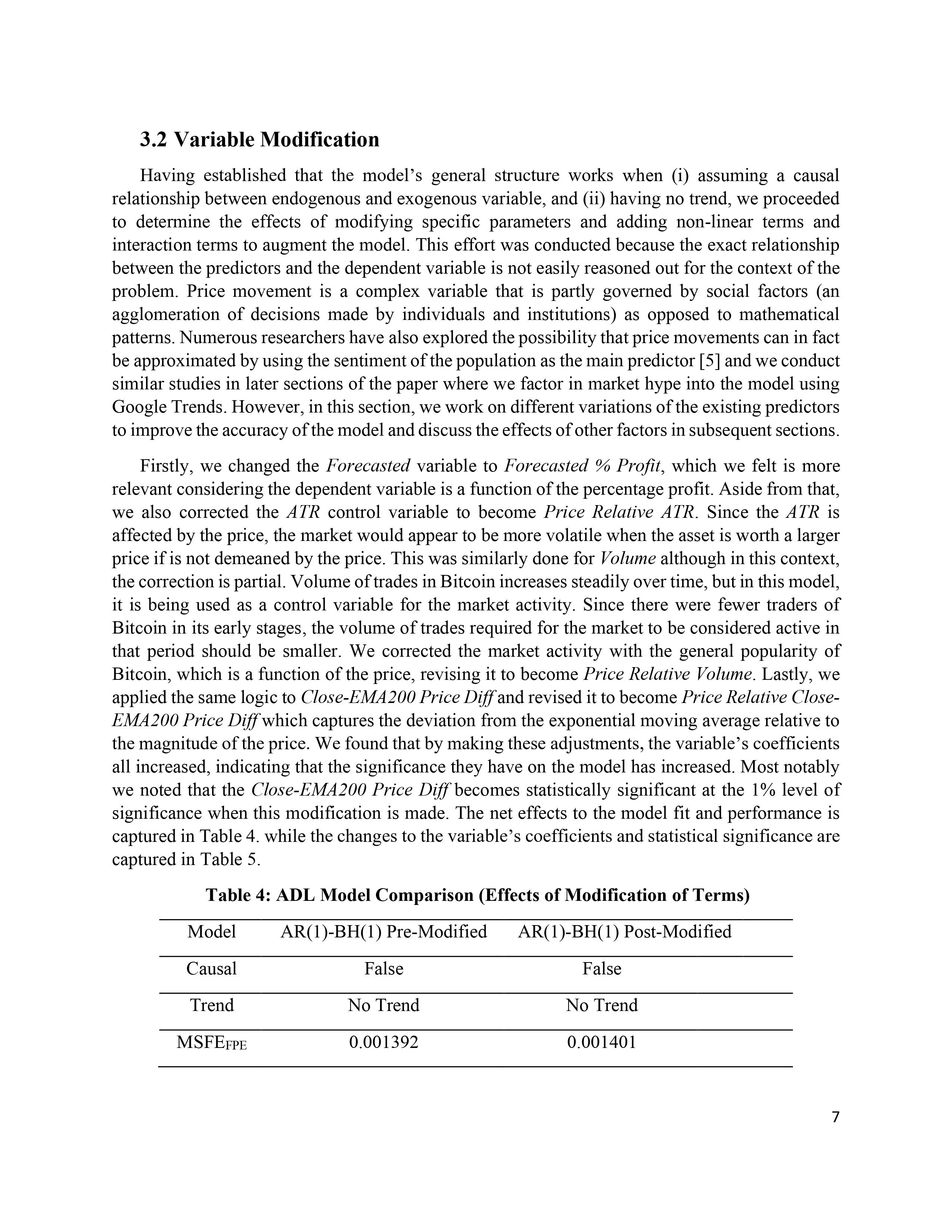

The report explaining the project is as seen below. As my group was busy working on other projects, most of the programming and writing was completed by me.

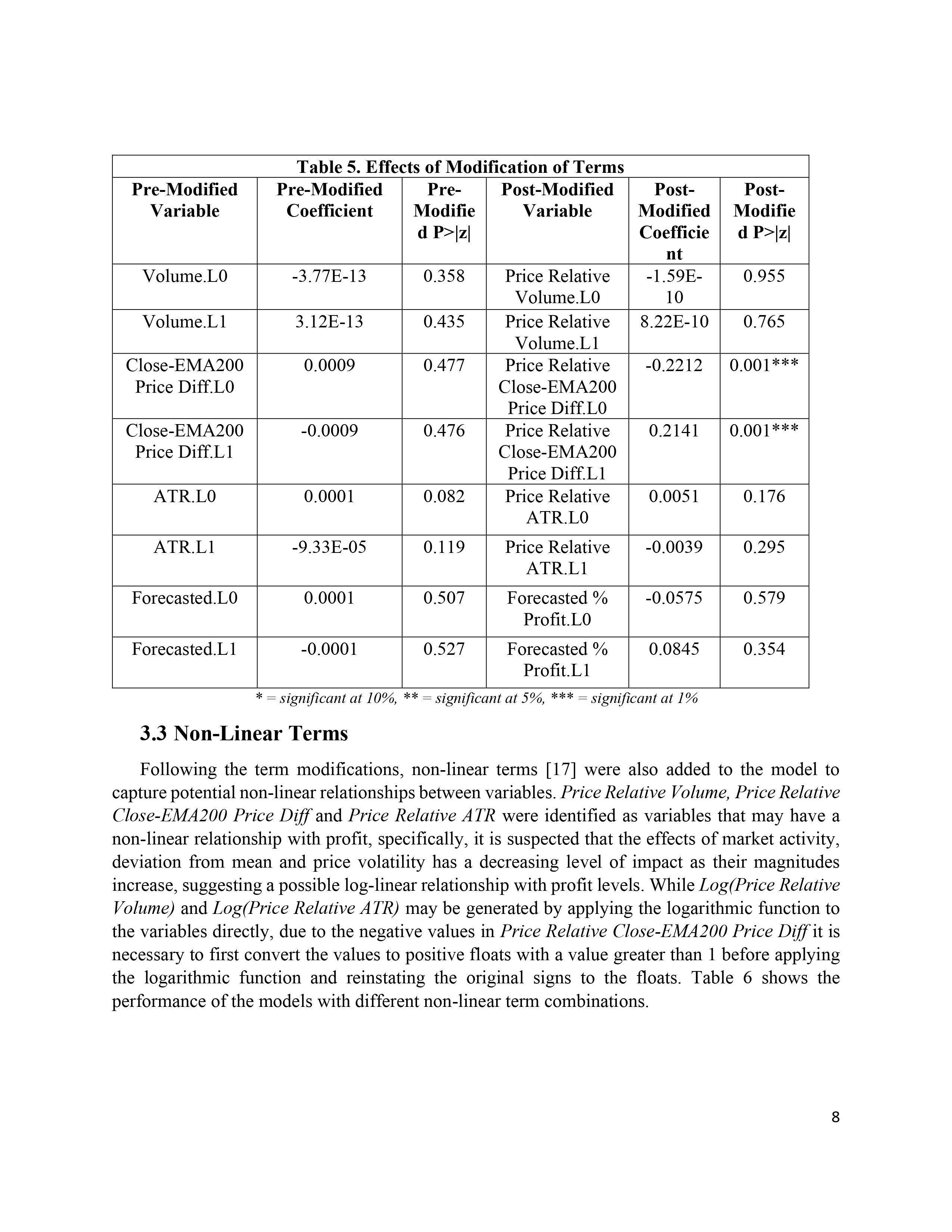

The contents of the notebook appended below dive straight into the first of 5 stages:

import pandas as pd

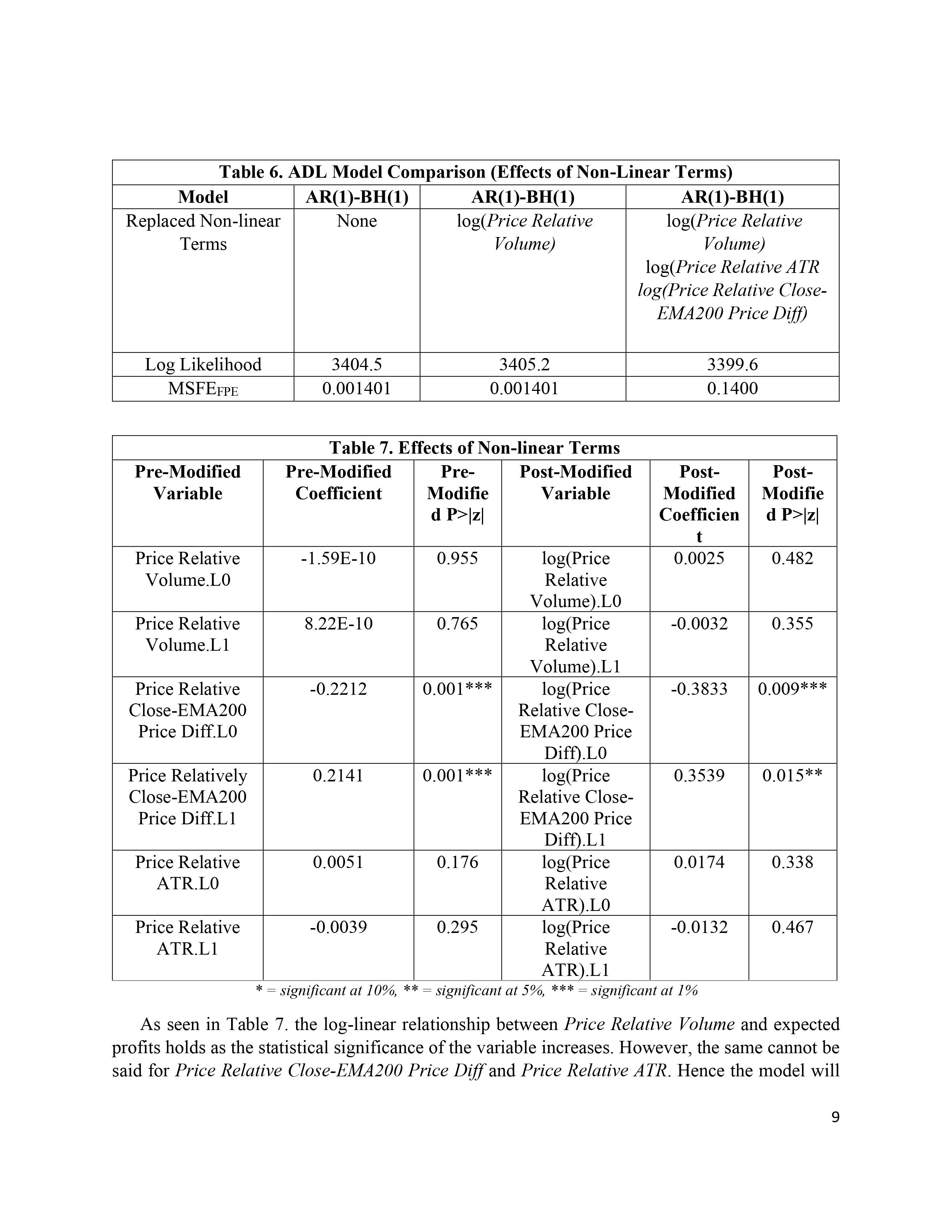

sti_df = pd.read_csv('STI (Singapore).csv')

sti_df

| Date | Open | High | Low | Close | |

|---|---|---|---|---|---|

| 0 | 10/08/21 | 3110.82 | 3112.81 | 3112.81 | 3112.81 |

| 1 | 10/07/21 | 3099.99 | 3118.52 | 3098.81 | 3101.15 |

| 2 | 10/06/21 | 3082.58 | 3091.35 | 3066.38 | 3083.88 |

| 3 | 10/05/21 | 3071.93 | 3071.93 | 3047.38 | 3068.12 |

| 4 | 10/04/21 | 3079.99 | 3102.47 | 3079.62 | 3089.65 |

| ... | ... | ... | ... | ... | ... |

| 942 | 01/08/18 | 3498.62 | 3514.76 | 3494.54 | 3512.18 |

| 943 | 01/05/18 | 3502.34 | 3503.68 | 3480.22 | 3489.45 |

| 944 | 01/04/18 | 3476.43 | 3501.16 | 3465.95 | 3501.16 |

| 945 | 01/03/18 | 3434.70 | 3468.19 | 3432.87 | 3464.28 |

| 946 | 01/02/18 | 3406.48 | 3433.82 | 3403.87 | 3430.30 |

947 rows × 5 columns

sti_df.columns

Index(['Date', 'Open', 'High', 'Low', 'Close', 'Volume'], dtype='object')

import talib

import numpy as np

sti_rsi = talib.RSI(sti_df[' Close'], timeperiod=14)

d = {'Date': sti_df['Date'], ' RSI': sti_rsi}

sti_rsi_df = pd.DataFrame(data=d)

sti_rsi_df['RSI Condition'] = sti_rsi_df[' RSI'].copy()

sti_rsi_df[' Close'] = sti_df[' Close']

sti_rsi_df.loc[sti_rsi_df['RSI Condition'] <= 30, 'RSI Condition'] = 1

sti_rsi_df.loc[(sti_rsi_df['RSI Condition'] > 30) & (sti_rsi_df['RSI Condition'] < 70), 'RSI Condition'] = 0

sti_rsi_df.loc[sti_rsi_df['RSI Condition'] >= 70, 'RSI Condition'] = -1

sti_rsi_df[' RSI'] = sti_rsi_df[' RSI']*30

sti_rsi_df.describe()

| RSI | RSI Condition | Close | |

|---|---|---|---|

| count | 933.000000 | 933.000000 | 947.00000 |

| mean | 1497.511185 | -0.011790 | 3084.51773 |

| std | 370.906023 | 0.325705 | 293.85772 |

| min | 378.636955 | -1.000000 | 2233.48000 |

| 25% | 1232.309343 | 0.000000 | 2973.59500 |

| 50% | 1507.572202 | 0.000000 | 3156.28000 |

| 75% | 1761.470849 | 0.000000 | 3247.51500 |

| max | 2435.438332 | 1.000000 | 3615.28000 |

import matplotlib.pyplot as plt

import numpy as np

import seaborn as sns

fig, ax = plt.subplots(figsize=(14, 15), dpi=80)

color_dict = dict({0:'black',

1:'green',

-1: 'red'})

markers = dict({0:'o',

1:'^',

-1: 'v'})

size_dict = dict({0:3,

1:100,

-1:100})

p0 = sns.lineplot(data=sti_df, x="Date", y="Close", ax=ax)

p1 = sns.lineplot(data=sti_rsi_df, x="Date", y=" RSI", label='RSI Condition', ax=ax)

p3 = sns.scatterplot(data=sti_rsi_df, x= "Date", y=' Close', hue ='RSI Condition', palette=color_dict, style='RSI Condition', markers=markers, size='RSI Condition', sizes=size_dict, ax=ax)

p5 = sns.lineplot(data=sti_ema_df, x="Date", y=" EMA200", ax=ax)

sti_macd, sti_macdsignal, sti_macdhist = talib.MACD(sti_df[' Close'], fastperiod=12, slowperiod=26, signalperiod=9)

d = {'Date': sti_df['Date'], ' MACD': sti_macd, ' MACD_SIG': sti_macdsignal}

sti_macd_df = pd.DataFrame(data=d)

sti_macd_df['MACD Condition'] = 0

for df_entry in range(len(sti_macd_df)-1):

#MACD crossing MACD_SIGNAL from above

if sti_macd_df[' MACD'][df_entry] > sti_macd_df[' MACD_SIG'][df_entry] and sti_macd_df[' MACD'][df_entry+1] < sti_macd_df[' MACD_SIG'][df_entry+1]:

sti_macd_df['MACD Condition'][df_entry] = -1

#print(sti_macd_df[' MACD'][df_entry],sti_macd_df[' MACD_SIG'][df_entry],sti_macd_df[' MACD'][df_entry+1],sti_macd_df[' MACD_SIG'][df_entry+1])

#MACD crossing MACD_SIGNAL from below

if sti_macd_df[' MACD'][df_entry] < sti_macd_df[' MACD_SIG'][df_entry] and sti_macd_df[' MACD'][df_entry+1] > sti_macd_df[' MACD_SIG'][df_entry+1]:

sti_macd_df['MACD Condition'][df_entry] = 1

#print(sti_macd_df[' MACD'][df_entry],sti_macd_df[' MACD_SIG'][df_entry],sti_macd_df[' MACD'][df_entry+1],sti_macd_df[' MACD_SIG'][df_entry+1])

sti_macd_orders_df = sti_macd_df.loc[sti_macd_df['MACD Condition'] != 0]

sti_macd_orders_df[' Close'] = sti_df[' Close']

sti_macd_orders_df

| Date | MACD | MACD_SIG | MACD Condition | Close | |

|---|---|---|---|---|---|

| 48 | 08/02/21 | 22.884501 | 22.061499 | -1 | 3161.22 |

| 78 | 06/18/21 | -4.643763 | -4.378131 | 1 | 3144.16 |

| 94 | 05/27/21 | 9.306626 | 8.015733 | -1 | 3164.82 |

| 104 | 05/11/21 | -9.995296 | -6.626359 | 1 | 3144.27 |

| 117 | 04/22/21 | 16.693823 | 14.232237 | -1 | 3187.78 |

| 129 | 04/06/21 | 7.638559 | 8.541848 | 1 | 3207.63 |

| 130 | 04/05/21 | 8.593651 | 8.552209 | -1 | 3209.74 |

| 163 | 02/16/21 | -58.695592 | -56.955417 | 1 | 2935.34 |

| 189 | 01/08/21 | 6.562785 | 1.888375 | -1 | 2993.19 |

| 203 | 12/17/20 | -31.689540 | -30.421307 | 1 | 2858.02 |

| 223 | 11/19/20 | -14.055077 | -14.396825 | -1 | 2777.00 |

| 241 | 10/26/20 | -90.266664 | -84.942385 | 1 | 2523.31 |

| 262 | 09/25/20 | -34.406512 | -35.417761 | -1 | 2472.28 |

| 263 | 09/24/20 | -35.811041 | -35.496417 | 1 | 2450.82 |

| 296 | 08/07/20 | 11.672184 | 11.499999 | -1 | 2545.51 |

| 302 | 07/29/20 | 2.400187 | 5.330226 | 1 | 2573.45 |

| 320 | 07/02/20 | 27.883170 | 26.799752 | -1 | 2636.69 |

| 330 | 06/18/20 | 12.121897 | 12.217050 | 1 | 2665.66 |

| 332 | 06/16/20 | 15.860785 | 13.300578 | -1 | 2666.85 |

| 333 | 06/15/20 | 12.572020 | 13.154867 | 1 | 2613.88 |

| 341 | 06/03/20 | 34.591966 | 31.669871 | -1 | 2700.39 |

| 355 | 05/13/20 | -28.725058 | -25.382535 | 1 | 2572.01 |

| 365 | 04/27/20 | -10.388541 | -12.536940 | -1 | 2549.40 |

| 369 | 04/21/20 | -14.227936 | -13.668312 | 1 | 2551.92 |

| 376 | 04/09/20 | 0.985250 | -2.654478 | -1 | 2571.32 |

| 393 | 03/17/20 | -45.158100 | -43.403953 | 1 | 2454.53 |

| 415 | 02/14/20 | 158.739979 | 155.281691 | -1 | 3220.03 |

| 468 | 11/28/19 | -5.971144 | -5.524743 | 1 | 3200.61 |

| 486 | 11/04/19 | 13.879359 | 13.316145 | -1 | 3236.40 |

| 508 | 10/02/19 | -30.703805 | -29.430481 | 1 | 3103.45 |

| 526 | 09/06/19 | 5.586083 | 5.196515 | -1 | 3144.48 |

| 537 | 08/22/19 | -16.588957 | -14.544033 | 1 | 3127.74 |

| 562 | 07/16/19 | 57.919169 | 56.524126 | -1 | 3360.03 |

| 597 | 05/27/19 | -39.318849 | -38.838729 | 1 | 3170.77 |

| 621 | 04/18/19 | 36.843771 | 35.875586 | -1 | 3347.58 |

| 649 | 03/11/19 | -25.401707 | -24.970355 | 1 | 3191.42 |

| 667 | 02/13/19 | 4.059838 | 2.642013 | -1 | 3244.77 |

| 681 | 01/22/19 | -14.519160 | -13.231035 | 1 | 3192.71 |

| 689 | 01/10/19 | -7.601291 | -7.828079 | -1 | 3183.51 |

| 703 | 12/19/18 | -41.543024 | -41.025006 | 1 | 3058.65 |

| 720 | 11/26/18 | -1.354578 | -2.683568 | -1 | 3093.38 |

| 730 | 11/12/18 | -14.471564 | -13.478231 | 1 | 3068.15 |

| 736 | 11/01/18 | -5.712429 | -9.171725 | -1 | 3060.85 |

| 743 | 10/23/18 | -20.196717 | -18.518421 | 1 | 3031.39 |

| 765 | 09/21/18 | 44.684944 | 43.832614 | -1 | 3217.68 |

| 778 | 09/04/18 | 3.230130 | 5.811819 | 1 | 3210.51 |

| 788 | 08/20/18 | 17.756090 | 17.317298 | -1 | 3204.71 |

| 791 | 08/15/18 | 16.213491 | 16.680341 | 1 | 3234.12 |

| 805 | 07/25/18 | 33.465886 | 31.569076 | -1 | 3326.83 |

| 825 | 06/27/18 | -3.190227 | -2.942481 | 1 | 3254.77 |

| 852 | 05/17/18 | 56.528375 | 54.849182 | -1 | 3536.76 |

| 889 | 03/23/18 | -29.634540 | -26.599996 | 1 | 3421.39 |

| 902 | 03/06/18 | 3.735910 | 3.481777 | -1 | 3491.92 |

| 905 | 03/01/18 | 1.480699 | 1.808240 | 1 | 3513.85 |

| 911 | 02/21/18 | 9.516414 | 7.510419 | -1 | 3516.23 |

| 922 | 02/05/18 | -19.990364 | -17.185425 | 1 | 3482.93 |

| 936 | 01/16/18 | 21.340834 | 21.283690 | -1 | 3550.21 |

import matplotlib.pyplot as plt

import numpy as np

import seaborn as sns

fig, ax = plt.subplots(figsize=(14, 15), dpi=80)

color_dict = dict({1:'green',

-1: 'red'})

markers = dict({1:'^',

-1: 'v'})

p0 = sns.lineplot(data=sti_df, x="Date", y=" Close", ax=ax)

sti_macd_df[" MACD"] = sti_macd_df[" MACD"]*30

sti_macd_df[" MACD_SIG"] = sti_macd_df[" MACD_SIG"] *30

p1 = sns.lineplot(data=sti_macd_df, x="Date", y=" MACD", label='MACD', ax=ax)

p2 = sns.lineplot(data=sti_macd_df, x="Date", y=" MACD_SIG", label='MACD_SIGNAL', ax=ax)

p3 = sns.scatterplot(data=sti_macd_orders_df, x= "Date", y=' Close', s=100, hue ='MACD Condition', palette=color_dict, style='MACD Condition', markers=markers, ax=ax)

sti_ema5 = talib.EMA(sti_df['Close'], timeperiod=5)

sti_ema25 = talib.EMA(sti_df['Close'], timeperiod=25)

sti_ema50 = talib.EMA(sti_df['Close'], timeperiod=50)

sti_ema100 = talib.EMA(sti_df['Close'], timeperiod=100)

sti_ema200 = talib.EMA(sti_df['Close'], timeperiod=200)

#used with the EMA25 to prevent trend trades too far from the EMA - likely trend reversal back to the EMA

ema25std = sti_ema_df[' EMA25'].std()*0.33

d = {'Date': sti_df['Date'],' EMA5': sti_ema5, ' EMA25': sti_ema25, ' EMA50': sti_ema50,' EMA100': sti_ema100, ' EMA200': sti_ema200, }

sti_ema_df = pd.DataFrame(data=d)

sti_ema_df[' Close'] = sti_df['Close']

sti_ema_df['EMA Condition'] = 0

sti_ema_df.loc[(sti_ema_df[' Close'] > sti_ema_df[' EMA5']) & (sti_ema_df[' Close'] > sti_ema_df[' EMA25']) & (sti_ema_df[' Close'] > sti_ema_df[' EMA50']) & (sti_ema_df[' Close'] > sti_ema_df[' EMA100']) & (sti_ema_df[' Close'] > sti_ema_df[' EMA200']), 'EMA Condition'] = 1

sti_ema_df.loc[(sti_ema_df[' Close'] < sti_ema_df[' EMA5']) & (sti_ema_df[' Close'] < sti_ema_df[' EMA25']) & (sti_ema_df[' Close'] < sti_ema_df[' EMA50']) & (sti_ema_df[' Close'] < sti_ema_df[' EMA100']) & (sti_ema_df[' Close'] < sti_ema_df[' EMA200']), 'EMA Condition'] = -1

sti_ema_df['Trend'] = 0

sti_ema_df.loc[sti_ema_df[' EMA200'] < sti_ema_df['Close'], 'Trend'] = 1

sti_ema_df.loc[sti_ema_df[' EMA200'] > sti_ema_df['Close'], 'Trend'] = -1

sti_ema_df.loc[sti_ema_df['EMA Condition']!=0]

import matplotlib.pyplot as plt

import numpy as np

import seaborn as sns

fig, ax = plt.subplots(figsize=(14, 15), dpi=80)

color_dict = dict({0:'black',

1:'green',

-1: 'red'})

size_dict = dict({0:3,

1:100,

-1:100})

markers = dict({0:'o',

1:'^',

-1: 'v'})

p0 = sns.lineplot(data=sti_df, x="Date", y=" Close", ax=ax)

p1 = sns.lineplot(data=sti_ema_df, x="Date", y=" EMA5", ax=ax)

p2 = sns.lineplot(data=sti_ema_df, x="Date", y=" EMA25", ax=ax)

p3 = sns.lineplot(data=sti_ema_df, x="Date", y=" EMA50", ax=ax)

p4 = sns.lineplot(data=sti_ema_df, x="Date", y=" EMA100", ax=ax)

p5 = sns.lineplot(data=sti_ema_df, x="Date", y=" EMA200", ax=ax)

p6 = sns.scatterplot(data=sti_ema_df, x= "Date", y=' Close', hue='EMA Condition', size='EMA Condition', palette=color_dict, sizes=size_dict, style='EMA Condition', markers=markers, ax=ax)

sti_ema5 = talib.EMA(sti_df[' Close'], timeperiod=5)

sti_ema25 = talib.EMA(sti_df[' Close'], timeperiod=25)

sti_ema50 = talib.EMA(sti_df[' Close'], timeperiod=50)

sti_ema100 = talib.EMA(sti_df[' Close'], timeperiod=100)

sti_ema200 = talib.EMA(sti_df[' Close'], timeperiod=200)

#used with the EMA25 to prevent trend trades too far from the EMA - likely trend reversal back to the EMA

ema25std = sti_ema_df[' EMA25'].std()*0.33

d = {'Date': sti_df['Date'],' EMA5': sti_ema5, ' EMA25': sti_ema25, ' EMA50': sti_ema50,' EMA100': sti_ema100, ' EMA200': sti_ema200, }

sti_ema_df = pd.DataFrame(data=d)

sti_ema_df[' Close'] = sti_df[' Close']

sti_ema_df['EMA Condition'] = 0

sti_ema_df.loc[(sti_ema_df[' Close'] > sti_ema_df[' EMA25']) & (sti_ema_df[' Close'] > sti_ema_df[' EMA50']) & (sti_ema_df[' Close'] > sti_ema_df[' EMA100']) & (sti_ema_df[' Close'] > sti_ema_df[' EMA200']) & (sti_ema_df[' Close'] < sti_ema_df[' EMA25']+ema25std), 'EMA Condition'] = 1

sti_ema_df.loc[(sti_ema_df[' Close'] < sti_ema_df[' EMA25']) & (sti_ema_df[' Close'] < sti_ema_df[' EMA50']) & (sti_ema_df[' Close'] < sti_ema_df[' EMA100']) & (sti_ema_df[' Close'] < sti_ema_df[' EMA200']) & (sti_ema_df[' Close'] > sti_ema_df[' EMA25']-ema25std), 'EMA Condition'] = -1

sti_ema_df.loc[sti_ema_df['EMA Condition']!=0]

| Date | EMA5 | EMA25 | EMA50 | EMA100 | EMA200 | Close | EMA Condition | |

|---|---|---|---|---|---|---|---|---|

| 199 | 12/23/20 | 2845.550552 | 2907.778109 | 2950.038881 | 3006.146875 | 3084.858200 | 2833.40 | -1 |

| 200 | 12/22/20 | 2839.473701 | 2901.589024 | 2945.226376 | 3002.605749 | 3082.295631 | 2827.32 | -1 |

| 201 | 12/21/20 | 2841.822468 | 2897.352945 | 2941.355537 | 2999.514942 | 3079.949605 | 2846.52 | -1 |

| 202 | 12/18/20 | 2844.208312 | 2893.631949 | 2937.732967 | 2996.534052 | 3077.651400 | 2848.98 | -1 |

| 203 | 12/17/20 | 2848.812208 | 2890.892568 | 2934.606968 | 2993.791200 | 3075.466013 | 2858.02 | -1 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 934 | 01/18/18 | 3552.298041 | 3520.351460 | 3501.564940 | 3464.786125 | 3390.491557 | 3521.31 | 1 |

| 935 | 01/17/18 | 3548.835361 | 3522.009809 | 3503.147099 | 3466.313331 | 3391.998208 | 3541.91 | 1 |

| 936 | 01/16/18 | 3549.293574 | 3524.179055 | 3504.992703 | 3467.974651 | 3393.572454 | 3550.21 | 1 |

| 937 | 01/15/18 | 3544.999049 | 3525.119897 | 3506.224754 | 3469.329806 | 3394.993724 | 3536.41 | 1 |

| 941 | 01/09/18 | 3525.558948 | 3523.660918 | 3508.215560 | 3473.197631 | 3399.880045 | 3524.65 | 1 |

365 rows × 8 columns

import matplotlib.pyplot as plt

import numpy as np

import seaborn as sns

fig, ax = plt.subplots(figsize=(14, 15), dpi=80)

color_dict = dict({0:'black',

1:'green',

-1: 'red'})

size_dict = dict({0:3,

1:100,

-1:100})

markers = dict({0:'o',

1:'^',

-1: 'v'})

p1 = sns.lineplot(data=sti_df, x="Date", y=" Close", ax=ax)

p2 = sns.lineplot(data=sti_ema_df, x="Date", y=" EMA25", ax=ax)

p3 = sns.lineplot(data=sti_ema_df, x="Date", y=" EMA50", ax=ax)

p4 = sns.lineplot(data=sti_ema_df, x="Date", y=" EMA100", ax=ax)

p5 = sns.lineplot(data=sti_ema_df, x="Date", y=" EMA200", ax=ax)

p6 = sns.scatterplot(data=sti_ema_df, x= "Date", y=' Close', hue='EMA Condition', size='EMA Condition', palette=color_dict, sizes=size_dict, style='EMA Condition', markers=markers, ax=ax)

sti_ema25 = talib.EMA(sti_df[' Close'], timeperiod=25)

sti_ema50 = talib.EMA(sti_df[' Close'], timeperiod=50)

sti_ema100 = talib.EMA(sti_df[' Close'], timeperiod=100)

sti_ema200 = talib.EMA(sti_df[' Close'], timeperiod=200)

#used with the EMA25 to prevent trend trades too far from the EMA - likely trend reversal back to the EMA

ema25std = sti_ema_df[' EMA25'].std()*0.33

d = {'Date': sti_df['Date'], ' EMA25': sti_ema25, ' EMA50': sti_ema50,' EMA100': sti_ema100, ' EMA200': sti_ema200, }

sti_ema_df = pd.DataFrame(data=d)

sti_ema_df[' Close'] = sti_df[' Close']

sti_ema_df['EMA Condition'] = 0

sti_ema_df.loc[(sti_ema_df[' Close'] < sti_ema_df[' EMA100']) & (sti_ema_df[' Close'] > sti_ema_df[' EMA200']), 'EMA Condition'] = 1

sti_ema_df.loc[(sti_ema_df[' Close'] > sti_ema_df[' EMA100']) & (sti_ema_df[' Close'] < sti_ema_df[' EMA200']), 'EMA Condition'] = -1

sti_ema_df.loc[sti_ema_df['EMA Condition']!=0]

| Date | EMA25 | EMA50 | EMA100 | EMA200 | Close | EMA Condition | |

|---|---|---|---|---|---|---|---|

| 308 | 07/21/20 | 2561.574174 | 2558.888224 | 2615.648404 | 2751.762641 | 2629.45 | -1 |

| 309 | 07/20/20 | 2565.783853 | 2561.139666 | 2615.661307 | 2750.414754 | 2616.30 | -1 |

| 310 | 07/17/20 | 2569.837403 | 2563.388307 | 2615.717123 | 2749.101971 | 2618.48 | -1 |

| 311 | 07/16/20 | 2573.978372 | 2565.752295 | 2615.874605 | 2747.853891 | 2623.67 | -1 |

| 312 | 07/15/20 | 2579.741574 | 2569.012989 | 2616.528574 | 2746.869275 | 2648.90 | -1 |

| ... | ... | ... | ... | ... | ... | ... | ... |

| 919 | 02/08/18 | 3462.526735 | 3470.235786 | 3439.735186 | 3367.164380 | 3415.90 | 1 |

| 920 | 02/07/18 | 3456.468524 | 3466.844971 | 3438.626964 | 3367.329610 | 3383.77 | 1 |

| 921 | 02/06/18 | 3452.615561 | 3464.473796 | 3437.988411 | 3367.718171 | 3406.38 | 1 |

| 945 | 01/03/18 | 3514.558519 | 3505.685326 | 3474.599973 | 3403.476557 | 3464.28 | 1 |

| 946 | 01/02/18 | 3508.077095 | 3502.729039 | 3473.722745 | 3403.743457 | 3430.30 | 1 |

116 rows × 7 columns

import matplotlib.pyplot as plt

import numpy as np

import seaborn as sns

fig, ax = plt.subplots(figsize=(14, 15), dpi=80)

color_dict = dict({0:'black',

1:'green',

-1: 'red'})

size_dict = dict({0:3,

1:100,

-1:100})

markers = dict({0:'o',

1:'^',

-1: 'v'})

p1 = sns.lineplot(data=sti_df, x="Date", y=" Close", ax=ax)

p2 = sns.lineplot(data=sti_ema_df, x="Date", y=" EMA25", ax=ax)

p3 = sns.lineplot(data=sti_ema_df, x="Date", y=" EMA50", ax=ax)

p4 = sns.lineplot(data=sti_ema_df, x="Date", y=" EMA100", ax=ax)

p5 = sns.lineplot(data=sti_ema_df, x="Date", y=" EMA200", ax=ax)

p6 = sns.scatterplot(data=sti_ema_df, x= "Date", y=' Close', hue='EMA Condition', size='EMA Condition', palette=color_dict, sizes=size_dict, style='EMA Condition', markers=markers, ax=ax)

Next step is to label each order based on conditions as the price change.

sti_atr = talib.ATR(sti_df[' High'], sti_df[' Low'], sti_df[' Close'], timeperiod=14)

d = {'Date': sti_df['Date'], ' ATR': sti_atr }

sti_atr_df = pd.DataFrame(data=d)

sti_atr_df[' Close'] = sti_df[' Close']

import matplotlib.pyplot as plt

import numpy as np

import seaborn as sns

fig, ax = plt.subplots(figsize=(14, 15), dpi=80)

p1 = sns.lineplot(data=sti_df, x="Date", y=" Close", ax=ax)

p2 = sns.lineplot(data=sti_atr_df, x="Date", y=" ATR", ax=ax)

p6 = sns.scatterplot(data=sti_atr_df, x= "Date", y=' Close', hue=' ATR', size=' ATR', ax=ax)

sti_bb_upperband, sti_bb_middleband, sti_bb_lowerband = talib.BBANDS(sti_df[' Close'], timeperiod=20, nbdevup=2, nbdevdn=2, matype=0)

d = {'Date': sti_df['Date'], ' Upper BB': sti_bb_upperband,' Middle BB': sti_bb_middleband, ' Lower BB': sti_bb_lowerband,}

sti_bb_df = pd.DataFrame(data=d)

sti_bb_df[' Close'] = sti_df[' Close']

sti_bb_df['BB Condition'] = 0

sti_bb_df.loc[(sti_bb_df[' Close'] > sti_bb_df[' Upper BB']), 'BB Condition'] = -1

sti_bb_df.loc[(sti_bb_df[' Close'] < sti_bb_df[' Lower BB']), 'BB Condition'] = 1

sti_bb_df.loc[sti_bb_df['BB Condition'] != 0]

| Date | Upper BB | Middle BB | Lower BB | Close | BB Condition | |

|---|---|---|---|---|---|---|

| 23 | 09/07/21 | 3107.548586 | 3073.3780 | 3039.207414 | 3108.53 | -1 |

| 37 | 08/18/21 | 3126.366066 | 3091.7720 | 3057.177934 | 3131.44 | -1 |

| 39 | 08/16/21 | 3138.603051 | 3097.2395 | 3055.875949 | 3145.52 | -1 |

| 40 | 08/13/21 | 3151.540724 | 3100.5740 | 3049.607276 | 3165.49 | -1 |

| 41 | 08/12/21 | 3166.624093 | 3106.1290 | 3045.633907 | 3182.80 | -1 |

| ... | ... | ... | ... | ... | ... | ... |

| 882 | 04/04/18 | 3667.130278 | 3519.3865 | 3371.642722 | 3339.70 | 1 |

| 915 | 02/14/18 | 3578.349382 | 3496.8240 | 3415.298618 | 3402.86 | 1 |

| 917 | 02/12/18 | 3574.989529 | 3482.1695 | 3389.349471 | 3384.98 | 1 |

| 945 | 01/03/18 | 3609.094193 | 3539.0965 | 3469.098807 | 3464.28 | 1 |

| 946 | 01/02/18 | 3617.484244 | 3533.1745 | 3448.864756 | 3430.30 | 1 |

134 rows × 6 columns

import matplotlib.pyplot as plt

import numpy as np

import seaborn as sns

fig, ax = plt.subplots(figsize=(14, 15), dpi=80)

color_dict = dict({0:'black',

1:'green',

-1: 'red'})

size_dict = dict({0:3,

1:100,

-1:100})

markers = dict({0:'o',

1:'^',

-1: 'v'})

p1 = sns.lineplot(data=sti_df, x="Date", y=" Close", ax=ax)

p2 = sns.lineplot(data=sti_bb_df, x="Date", y=" Upper BB", ax=ax)

p3 = sns.lineplot(data=sti_bb_df, x="Date", y=" Lower BB", ax=ax)

p6 = sns.scatterplot(data=sti_bb_df, x= "Date", y=' Close', hue='BB Condition', size='BB Condition', palette=color_dict, sizes=size_dict, style='BB Condition', markers=markers, ax=ax)

regression_data

| Date | Close | RSI Condition | MACD Condition | EMA Condition | BB Condition | ATR | Trend | |

|---|---|---|---|---|---|---|---|---|

| 0 | 10/08/21 | 3112.81 | NaN | 0 | 0 | 0 | NaN | 0 |

| 1 | 10/07/21 | 3101.15 | NaN | 0 | 0 | 0 | NaN | 0 |

| 2 | 10/06/21 | 3083.88 | NaN | 0 | 0 | 0 | NaN | 0 |

| 3 | 10/05/21 | 3068.12 | NaN | 0 | 0 | 0 | NaN | 0 |

| 4 | 10/04/21 | 3089.65 | NaN | 0 | 0 | 0 | NaN | 0 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 942 | 01/08/18 | 3512.18 | 0.0 | 0 | 0 | 0 | 34.309687 | 1 |

| 943 | 01/05/18 | 3489.45 | 0.0 | 0 | 0 | 0 | 34.141852 | 1 |

| 944 | 01/04/18 | 3501.16 | 0.0 | 0 | 0 | 0 | 34.218149 | 1 |

| 945 | 01/03/18 | 3464.28 | 0.0 | 0 | 0 | 1 | 36.651852 | 1 |

| 946 | 01/02/18 | 3430.30 | 0.0 | 0 | 0 | 1 | 38.348863 | 1 |

947 rows × 8 columns

regression_data.describe()

| Close | RSI Condition | MACD Condition | EMA Condition | BB Condition | ATR | Trend | |

|---|---|---|---|---|---|---|---|

| count | 947.00000 | 933.000000 | 947.000000 | 947.000000 | 947.000000 | 933.000000 | 947.000000 |

| mean | 3084.51773 | -0.011790 | -0.001056 | 0.070750 | 0.012672 | 36.134035 | 0.202746 |

| std | 293.85772 | 0.325705 | 0.245464 | 0.583657 | 0.376149 | 14.278629 | 0.865765 |

| min | 2233.48000 | -1.000000 | -1.000000 | -1.000000 | -1.000000 | 18.465510 | -1.000000 |

| 25% | 2973.59500 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 26.858795 | -1.000000 |

| 50% | 3156.28000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 34.165970 | 0.000000 |

| 75% | 3247.51500 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 41.424344 | 1.000000 |

| max | 3615.28000 | 1.000000 | 1.000000 | 1.000000 | 1.000000 | 119.844777 | 1.000000 |

import numpy as np

future_price_dict = dict()

for future in [1,3,5,10,15,30]:

future_price_dict['future_price'+str(future)] = list(regression_data[' Close'])[future:] + [np.NaN for i in range(future)]

future_price_dict['future_price3']

[3068.12,

3089.65,

3051.11,

3086.7,

...]

for future_price in future_price_dict:

regression_data[future_price] = future_price_dict[future_price]

regression_data.dropna(inplace= True)

regression_data

| Date | Close | RSI Condition | MACD Condition | EMA Condition | BB Condition | ATR | Trend | future_price1 | future_price3 | future_price5 | future_price10 | future_price15 | future_price30 | future_price1 P/L | future_price3 P/L | future_price5 P/L | future_price10 P/L | future_price15 P/L | future_price30 P/L | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 14 | 09/20/21 | 3041.73 | 0.0 | 0 | 0 | 0 | 32.930000 | 0 | 3071.23 | 3058.61 | 3074.31 | 3101.08 | 3102.11 | 3177.18 | 29.50 | 16.88 | 32.58 | 59.35 | 60.38 | 135.45 |

| 15 | 09/17/21 | 3071.23 | 0.0 | 0 | 0 | 0 | 32.685000 | 0 | 3064.54 | 3080.37 | 3098.80 | 3083.85 | 3080.77 | 3175.10 | -6.69 | 9.14 | 27.57 | 12.62 | 9.54 | 103.87 |

| 16 | 09/16/21 | 3064.54 | 0.0 | 0 | 0 | 0 | 30.828214 | 0 | 3058.61 | 3074.31 | 3071.70 | 3088.84 | 3109.42 | 3182.90 | -5.93 | 9.77 | 7.16 | 24.30 | 44.88 | 118.36 |

| 17 | 09/15/21 | 3058.61 | 0.0 | 0 | 0 | 0 | 29.943342 | 0 | 3080.37 | 3098.80 | 3068.94 | 3087.84 | 3107.49 | 3149.25 | 21.76 | 40.19 | 10.33 | 29.23 | 48.88 | 90.64 |

| 18 | 09/14/21 | 3080.37 | 0.0 | 0 | 0 | 0 | 29.358817 | 0 | 3074.31 | 3071.70 | 3108.53 | 3055.05 | 3107.62 | 3161.22 | -6.06 | -8.67 | 28.16 | -25.32 | 27.25 | 80.85 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 912 | 02/20/18 | 3476.53 | 0.0 | 0 | 0 | 0 | 45.251056 | 1 | 3487.88 | 3402.86 | 3384.98 | 3482.93 | 3577.07 | 3512.18 | 11.35 | -73.67 | -91.55 | 6.40 | 100.54 | 35.65 |

| 913 | 02/19/18 | 3487.88 | 0.0 | 0 | 0 | 0 | 44.438838 | 1 | 3443.51 | 3415.07 | 3377.24 | 3529.82 | 3567.14 | 3489.45 | -44.37 | -72.81 | -110.64 | 41.94 | 79.26 | 1.57 |

| 914 | 02/15/18 | 3443.51 | 0.0 | 0 | 0 | 0 | 46.433921 | 1 | 3402.86 | 3384.98 | 3415.90 | 3547.23 | 3572.62 | 3501.16 | -40.65 | -58.53 | -27.61 | 103.72 | 129.11 | 57.65 |

| 915 | 02/14/18 | 3402.86 | 0.0 | 0 | 0 | 1 | 46.020784 | 1 | 3415.07 | 3377.24 | 3383.77 | 3533.99 | 3609.24 | 3464.28 | 12.21 | -25.62 | -19.09 | 131.13 | 206.38 | 61.42 |

| 916 | 02/13/18 | 3415.07 | 0.0 | 0 | 0 | 0 | 45.478585 | 1 | 3384.98 | 3415.90 | 3406.38 | 3548.74 | 3592.08 | 3430.30 | -30.09 | 0.83 | -8.69 | 133.67 | 177.01 | 15.23 |

903 rows × 20 columns

regression_data.loc[regression_data['MACD Condition']==-1].describe()

| Close | RSI Condition | MACD Condition | EMA Condition | BB Condition | ATR | Trend | future_price1 | future_price3 | future_price5 | future_price10 | future_price15 | future_price30 | future_price1 P/L | future_price3 P/L | future_price5 P/L | future_price10 P/L | future_price15 P/L | future_price30 P/L | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 28.000000 | 28.000000 | 28.0 | 28.000000 | 28.000000 | 28.000000 | 28.000000 | 28.000000 | 28.000000 | 28.000000 | 28.000000 | 28.000000 | 28.000000 | 28.000000 | 28.000000 | 28.000000 | 28.000000 | 28.000000 | 28.000000 |

| mean | 3065.048214 | -0.035714 | -1.0 | -0.071429 | 0.035714 | 35.796943 | 0.035714 | 3039.390000 | 3025.827857 | 3024.046071 | 3020.603929 | 3008.459286 | 3048.964643 | -25.658214 | -39.220357 | -41.002143 | -44.444286 | -56.588929 | -16.083571 |

| std | 318.714475 | 0.188982 | 0.0 | 0.662687 | 0.188982 | 9.765215 | 0.922241 | 322.483239 | 333.169174 | 321.379377 | 321.460698 | 353.519686 | 308.015070 | 26.249121 | 50.755690 | 67.249032 | 68.489702 | 101.420167 | 169.004492 |

| min | 2472.280000 | -1.000000 | -1.0 | -1.000000 | 0.000000 | 22.699652 | -1.000000 | 2450.820000 | 2463.290000 | 2453.030000 | 2487.560000 | 2311.000000 | 2543.110000 | -88.760000 | -189.640000 | -180.910000 | -188.380000 | -326.320000 | -329.100000 |

| 25% | 2757.847500 | 0.000000 | -1.0 | -0.250000 | 0.000000 | 28.342162 | -1.000000 | 2744.912500 | 2737.052500 | 2773.602500 | 2652.332500 | 2684.075000 | 2810.662500 | -39.997500 | -65.122500 | -61.732500 | -83.407500 | -120.900000 | -110.570000 |

| 50% | 3174.165000 | 0.000000 | -1.0 | 0.000000 | 0.000000 | 35.723335 | 0.000000 | 3156.565000 | 3128.615000 | 3122.745000 | 3124.275000 | 3115.710000 | 3117.580000 | -27.290000 | -29.405000 | -42.545000 | -32.750000 | -29.635000 | -20.635000 |

| 75% | 3238.492500 | 0.000000 | -1.0 | 0.000000 | 0.000000 | 41.342051 | 1.000000 | 3222.425000 | 3215.820000 | 3199.272500 | 3211.895000 | 3224.060000 | 3235.110000 | -2.767500 | -9.432500 | -12.520000 | 9.307500 | 16.650000 | 83.482500 |

| max | 3536.760000 | 0.000000 | -1.0 | 1.000000 | 1.000000 | 64.668723 | 1.000000 | 3533.050000 | 3562.460000 | 3540.390000 | 3575.680000 | 3568.010000 | 3569.430000 | 13.590000 | 37.360000 | 127.320000 | 66.840000 | 120.270000 | 540.380000 |

regression_data.loc[(regression_data['MACD Condition']==-1) & (regression_data['Trend']==-1)].describe()

| Close | RSI Condition | MACD Condition | EMA Condition | BB Condition | ATR | Trend | future_price1 | future_price3 | future_price5 | future_price10 | future_price15 | future_price30 | future_price1 P/L | future_price3 P/L | future_price5 P/L | future_price10 P/L | future_price15 P/L | future_price30 P/L | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 11.000000 | 11.0 | 11.0 | 11.000000 | 11.000000 | 11.000000 | 11.0 | 11.000000 | 11.000000 | 11.000000 | 11.000000 | 11.000000 | 11.000000 | 11.000000 | 11.000000 | 11.000000 | 11.000000 | 11.000000 | 11.000000 |

| mean | 2750.652727 | 0.0 | -1.0 | -0.636364 | 0.090909 | 39.347001 | -1.0 | 2720.104545 | 2696.333636 | 2707.718182 | 2704.860000 | 2665.083636 | 2785.410909 | -30.548182 | -54.319091 | -42.934545 | -45.792727 | -85.569091 | 34.758182 |

| std | 248.297900 | 0.0 | 0.0 | 0.504525 | 0.301511 | 7.333805 | 0.0 | 245.600683 | 239.823212 | 228.770401 | 227.754133 | 281.697610 | 262.489733 | 28.251675 | 60.479219 | 91.934469 | 85.454995 | 135.082905 | 199.423848 |

| min | 2472.280000 | 0.0 | -1.0 | -1.000000 | 0.000000 | 26.288926 | -1.0 | 2450.820000 | 2463.290000 | 2453.030000 | 2487.560000 | 2311.000000 | 2543.110000 | -88.760000 | -189.640000 | -180.910000 | -188.380000 | -326.320000 | -233.890000 |

| 25% | 2560.360000 | 0.0 | -1.0 | -1.000000 | 0.000000 | 35.155502 | -1.0 | 2549.270000 | 2513.225000 | 2524.650000 | 2574.290000 | 2480.160000 | 2597.960000 | -41.470000 | -80.010000 | -91.695000 | -101.410000 | -149.040000 | -80.270000 |

| 50% | 2666.850000 | 0.0 | -1.0 | -1.000000 | 0.000000 | 40.250374 | -1.0 | 2611.630000 | 2574.100000 | 2597.850000 | 2611.630000 | 2587.810000 | 2628.620000 | -31.240000 | -54.730000 | -46.540000 | -25.230000 | -112.580000 | -24.210000 |

| 75% | 2918.925000 | 0.0 | -1.0 | 0.000000 | 0.000000 | 42.037396 | -1.0 | 2903.695000 | 2864.770000 | 2903.505000 | 2838.405000 | 2874.875000 | 3079.785000 | -23.450000 | -18.995000 | 4.870000 | 17.830000 | 30.185000 | 96.820000 |

| max | 3183.510000 | 0.0 | -1.0 | 0.000000 | 1.000000 | 51.300404 | -1.0 | 3158.070000 | 3102.800000 | 3065.070000 | 3069.670000 | 3116.390000 | 3180.430000 | 13.590000 | 37.360000 | 127.320000 | 66.840000 | 78.160000 | 540.380000 |

regression_data.loc[(regression_data['MACD Condition']==1)].describe()

| Close | RSI Condition | MACD Condition | EMA Condition | BB Condition | ATR | Trend | future_price1 | future_price3 | future_price5 | future_price10 | future_price15 | future_price30 | future_price1 P/L | future_price3 P/L | future_price5 P/L | future_price10 P/L | future_price15 P/L | future_price30 P/L | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 27.000000 | 27.0 | 27.0 | 27.000000 | 27.000000 | 27.000000 | 27.000000 | 27.000000 | 27.000000 | 27.000000 | 27.000000 | 27.000000 | 27.000000 | 27.000000 | 27.000000 | 27.000000 | 27.000000 | 27.000000 | 27.000000 |

| mean | 2980.538148 | 0.0 | 1.0 | 0.111111 | 0.037037 | 37.586677 | -0.111111 | 2999.415926 | 3013.316667 | 3026.528148 | 3021.459259 | 3039.157407 | 3026.689259 | 18.877778 | 32.778519 | 45.990000 | 40.921111 | 58.619259 | 46.151111 |

| std | 312.365448 | 0.0 | 0.0 | 0.423659 | 0.192450 | 15.961500 | 0.933700 | 308.364691 | 303.593496 | 292.246799 | 311.520715 | 336.434094 | 324.965521 | 22.686305 | 57.541186 | 80.737257 | 128.564614 | 169.484165 | 190.115287 |

| min | 2450.820000 | 0.0 | 1.0 | -1.000000 | 0.000000 | 20.193016 | -1.000000 | 2481.140000 | 2485.710000 | 2500.780000 | 2470.590000 | 2416.240000 | 2482.550000 | -13.110000 | -51.780000 | -33.060000 | -110.990000 | -150.420000 | -326.420000 |

| 25% | 2639.770000 | 0.0 | 1.0 | 0.000000 | 0.000000 | 26.958589 | -1.000000 | 2677.125000 | 2739.605000 | 2810.965000 | 2764.770000 | 2759.450000 | 2724.610000 | 3.035000 | 4.180000 | 1.635000 | -37.350000 | -5.860000 | -42.005000 |

| 50% | 3103.450000 | 0.0 | 1.0 | 0.000000 | 0.000000 | 38.696086 | 0.000000 | 3122.570000 | 3125.630000 | 3125.820000 | 3151.040000 | 3158.240000 | 3122.570000 | 14.080000 | 21.730000 | 34.690000 | 41.270000 | 38.310000 | 9.430000 |

| 75% | 3196.660000 | 0.0 | 1.0 | 0.000000 | 0.000000 | 41.638960 | 1.000000 | 3208.470000 | 3217.535000 | 3208.880000 | 3223.140000 | 3275.845000 | 3246.475000 | 34.230000 | 36.585000 | 54.810000 | 78.190000 | 86.540000 | 119.275000 |

| max | 3513.850000 | 0.0 | 1.0 | 1.000000 | 1.000000 | 105.759356 | 1.000000 | 3517.940000 | 3555.850000 | 3512.140000 | 3485.570000 | 3483.160000 | 3562.460000 | 70.750000 | 224.110000 | 378.010000 | 565.030000 | 703.710000 | 702.040000 |

regression_data.loc[(regression_data['MACD Condition']==1) & (regression_data['Trend']==1)].describe()

| Close | RSI Condition | MACD Condition | EMA Condition | BB Condition | ATR | Trend | future_price1 | future_price3 | future_price5 | future_price10 | future_price15 | future_price30 | future_price1 P/L | future_price3 P/L | future_price5 P/L | future_price10 P/L | future_price15 P/L | future_price30 P/L | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 10.00000 | 10.0 | 10.0 | 10.000000 | 10.0 | 10.000000 | 10.0 | 10.000000 | 10.000000 | 10.00000 | 10.000000 | 10.000000 | 10.000000 | 10.000000 | 10.000000 | 10.000000 | 10.000000 | 10.000000 | 10.000000 |

| mean | 3242.86300 | 0.0 | 1.0 | 0.400000 | 0.0 | 32.928918 | 1.0 | 3259.014000 | 3274.775000 | 3280.47100 | 3295.869000 | 3338.316000 | 3315.912000 | 16.151000 | 31.912000 | 37.608000 | 53.006000 | 95.453000 | 73.049000 |

| std | 128.62053 | 0.0 | 0.0 | 0.516398 | 0.0 | 8.840026 | 0.0 | 137.298721 | 147.666712 | 135.33644 | 111.564947 | 95.793959 | 154.486478 | 23.937599 | 25.659124 | 42.677631 | 74.978376 | 109.381312 | 115.358465 |

| min | 3103.45000 | 0.0 | 1.0 | 0.000000 | 0.0 | 22.969980 | 1.0 | 3122.570000 | 3125.630000 | 3125.82000 | 3166.840000 | 3204.520000 | 3122.570000 | -5.170000 | 0.710000 | -25.390000 | -110.990000 | -130.080000 | -65.900000 |

| 25% | 3175.93250 | 0.0 | 1.0 | 0.000000 | 0.0 | 26.000642 | 1.0 | 3176.385000 | 3192.512500 | 3195.52250 | 3211.495000 | 3270.907500 | 3202.022500 | 0.362500 | 16.412500 | 4.355000 | 34.112500 | 57.990000 | -0.072500 |

| 50% | 3205.56000 | 0.0 | 1.0 | 0.000000 | 0.0 | 30.962074 | 1.0 | 3211.365000 | 3224.280000 | 3249.31500 | 3272.925000 | 3321.595000 | 3312.740000 | 6.600000 | 26.800000 | 35.865000 | 63.785000 | 79.830000 | 23.590000 |

| 75% | 3249.60750 | 0.0 | 1.0 | 1.000000 | 0.0 | 39.598766 | 1.0 | 3271.370000 | 3286.745000 | 3333.97500 | 3382.107500 | 3390.160000 | 3394.290000 | 23.305000 | 39.657500 | 60.762500 | 84.530000 | 191.407500 | 139.490000 |

| max | 3513.85000 | 0.0 | 1.0 | 1.000000 | 0.0 | 47.524629 | 1.0 | 3517.940000 | 3555.850000 | 3512.14000 | 3485.570000 | 3483.160000 | 3562.460000 | 69.980000 | 91.920000 | 105.880000 | 175.920000 | 228.390000 | 307.690000 |

regression_data.loc[(regression_data['RSI Condition']==1) & (regression_data['Trend']==1)].describe()

| Close | RSI Condition | MACD Condition | EMA Condition | BB Condition | ATR | Trend | future_price1 | future_price3 | future_price5 | future_price10 | future_price15 | future_price30 | future_price1 P/L | future_price3 P/L | future_price5 P/L | future_price10 P/L | future_price15 P/L | future_price30 P/L | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 11.000000 | 11.0 | 11.0 | 11.0 | 11.000000 | 11.000000 | 11.0 | 11.000000 | 11.000000 | 11.000000 | 11.00000 | 11.000000 | 11.000000 | 11.000000 | 11.000000 | 11.000000 | 11.000000 | 11.000000 | 11.000000 |

| mean | 3195.342727 | 1.0 | 0.0 | 0.0 | 0.454545 | 29.551907 | 1.0 | 3196.502727 | 3194.729091 | 3202.897273 | 3213.89000 | 3254.249091 | 3323.247273 | 1.160000 | -0.613636 | 7.554545 | 18.547273 | 58.906364 | 127.904545 |

| std | 55.015693 | 0.0 | 0.0 | 0.0 | 0.522233 | 5.217553 | 0.0 | 77.623009 | 85.085579 | 85.013475 | 103.12348 | 103.083407 | 80.990060 | 27.442313 | 37.743414 | 41.153575 | 66.320764 | 71.144669 | 80.101817 |

| min | 3142.370000 | 1.0 | 0.0 | 0.0 | 0.000000 | 26.375988 | 1.0 | 3123.460000 | 3117.760000 | 3117.760000 | 3117.76000 | 3169.890000 | 3201.150000 | -21.820000 | -45.740000 | -70.350000 | -90.230000 | -38.100000 | 0.870000 |

| 25% | 3156.235000 | 1.0 | 0.0 | 0.0 | 0.000000 | 27.602351 | 1.0 | 3154.730000 | 3142.685000 | 3162.000000 | 3176.51500 | 3220.805000 | 3248.965000 | -18.135000 | -24.540000 | -10.330000 | -9.180000 | 25.175000 | 47.980000 |

| 50% | 3198.390000 | 1.0 | 0.0 | 0.0 | 0.000000 | 28.202436 | 1.0 | 3182.920000 | 3182.920000 | 3188.110000 | 3195.59000 | 3229.480000 | 3347.580000 | -5.190000 | -0.250000 | 10.070000 | -2.800000 | 42.150000 | 174.320000 |

| 75% | 3205.785000 | 1.0 | 0.0 | 0.0 | 1.000000 | 28.750831 | 1.0 | 3201.930000 | 3209.920000 | 3212.875000 | 3206.21500 | 3234.175000 | 3360.065000 | 8.265000 | 13.540000 | 19.180000 | 38.925000 | 84.720000 | 186.260000 |

| max | 3339.700000 | 1.0 | 0.0 | 0.0 | 1.000000 | 45.061932 | 1.0 | 3412.150000 | 3427.970000 | 3439.350000 | 3513.31000 | 3553.730000 | 3476.530000 | 72.450000 | 88.270000 | 99.650000 | 173.610000 | 214.030000 | 211.520000 |

regression_data.loc[(regression_data['RSI Condition']==1)].describe()

| Close | RSI Condition | MACD Condition | EMA Condition | BB Condition | ATR | Trend | future_price1 | future_price3 | future_price5 | future_price10 | future_price15 | future_price30 | future_price1 P/L | future_price3 P/L | future_price5 P/L | future_price10 P/L | future_price15 P/L | future_price30 P/L | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 44.000000 | 44.0 | 44.0 | 44.000000 | 44.000000 | 44.000000 | 44.000000 | 44.000000 | 44.000000 | 44.000000 | 44.000000 | 44.000000 | 44.000000 | 44.000000 | 44.000000 | 44.000000 | 44.000000 | 44.000000 | 44.000000 |

| mean | 2917.178636 | 1.0 | 0.0 | -0.431818 | 0.477273 | 36.420665 | -0.204545 | 2913.642045 | 2903.369318 | 2896.085682 | 2905.350227 | 2929.480682 | 2940.895455 | -3.536591 | -13.809318 | -21.092955 | -11.828409 | 12.302045 | 23.716818 |

| std | 256.653071 | 0.0 | 0.0 | 0.501056 | 0.505258 | 7.977353 | 0.823479 | 264.767901 | 274.931938 | 282.932416 | 287.958088 | 294.138856 | 337.611232 | 31.610656 | 58.736073 | 78.083901 | 96.780293 | 93.931161 | 119.961688 |

| min | 2423.840000 | 1.0 | 0.0 | -1.000000 | 0.000000 | 26.375988 | -1.000000 | 2423.840000 | 2423.840000 | 2423.840000 | 2423.840000 | 2523.620000 | 2450.820000 | -95.640000 | -145.490000 | -207.780000 | -287.550000 | -187.670000 | -246.660000 |

| 25% | 2711.772500 | 1.0 | 0.0 | -1.000000 | 0.000000 | 29.168108 | -1.000000 | 2710.175000 | 2604.175000 | 2568.357500 | 2542.025000 | 2554.797500 | 2500.770000 | -19.495000 | -47.010000 | -68.887500 | -43.035000 | -45.762500 | -23.917500 |

| 50% | 2973.705000 | 1.0 | 0.0 | 0.000000 | 0.000000 | 34.204931 | 0.000000 | 2973.270000 | 2942.190000 | 2928.680000 | 2929.435000 | 2926.655000 | 2997.345000 | -2.340000 | -2.000000 | -1.255000 | 9.065000 | 29.725000 | 26.255000 |

| 75% | 3142.527500 | 1.0 | 0.0 | 0.000000 | 1.000000 | 42.298924 | 0.250000 | 3142.527500 | 3142.527500 | 3161.360000 | 3173.202500 | 3219.787500 | 3240.997500 | 24.685000 | 30.632500 | 31.127500 | 40.747500 | 68.727500 | 78.702500 |

| max | 3339.700000 | 1.0 | 0.0 | 0.000000 | 1.000000 | 51.686716 | 1.000000 | 3412.150000 | 3427.970000 | 3439.350000 | 3513.310000 | 3553.730000 | 3476.530000 | 72.450000 | 89.030000 | 113.550000 | 173.610000 | 214.030000 | 225.180000 |

regression_data.loc[(regression_data['RSI Condition']==-1)].describe()

| Close | RSI Condition | MACD Condition | EMA Condition | BB Condition | ATR | Trend | future_price1 | future_price3 | future_price5 | future_price10 | future_price15 | future_price30 | future_price1 P/L | future_price3 P/L | future_price5 P/L | future_price10 P/L | future_price15 P/L | future_price30 P/L | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 55.000000 | 55.0 | 55.000000 | 55.000000 | 55.000000 | 55.000000 | 55.0 | 55.000000 | 55.000000 | 55.000000 | 55.000000 | 55.000000 | 55.000000 | 55.000000 | 55.000000 | 55.000000 | 55.000000 | 55.000000 | 55.000000 |

| mean | 3301.093818 | -1.0 | -0.018182 | 0.963636 | -0.381818 | 50.279923 | 1.0 | 3298.715091 | 3297.680909 | 3303.373455 | 3297.039091 | 3296.875273 | 3268.852909 | -2.378727 | -3.412909 | 2.279636 | -4.054727 | -4.218545 | -32.240909 |

| std | 188.755738 | 0.0 | 0.134840 | 0.188919 | 0.490310 | 23.791498 | 0.0 | 187.744452 | 195.742925 | 209.415855 | 231.614786 | 228.134477 | 222.795498 | 23.990542 | 46.162591 | 65.428661 | 96.994312 | 98.626907 | 139.132968 |

| min | 2794.170000 | -1.0 | -1.000000 | 0.000000 | -1.000000 | 25.593255 | 1.0 | 2751.500000 | 2700.390000 | 2550.860000 | 2499.830000 | 2523.550000 | 2518.160000 | -54.660000 | -115.240000 | -246.110000 | -297.140000 | -273.420000 | -282.410000 |

| 25% | 3213.355000 | -1.0 | 0.000000 | 1.000000 | -1.000000 | 33.677142 | 1.0 | 3206.565000 | 3205.840000 | 3213.355000 | 3197.655000 | 3221.730000 | 3212.530000 | -16.475000 | -41.095000 | -26.545000 | -45.510000 | -59.985000 | -160.650000 |

| 50% | 3346.390000 | -1.0 | 0.000000 | 1.000000 | 0.000000 | 43.504595 | 1.0 | 3350.540000 | 3356.950000 | 3353.470000 | 3334.230000 | 3325.600000 | 3247.860000 | 0.060000 | -7.530000 | 2.210000 | 0.450000 | 3.050000 | -17.550000 |

| 75% | 3418.855000 | -1.0 | 0.000000 | 1.000000 | 0.000000 | 61.071969 | 1.0 | 3417.265000 | 3417.265000 | 3417.265000 | 3437.115000 | 3411.110000 | 3352.090000 | 14.145000 | 24.995000 | 36.855000 | 59.365000 | 52.730000 | 78.335000 |

| max | 3615.280000 | -1.0 | 0.000000 | 1.000000 | 0.000000 | 117.485150 | 1.0 | 3613.930000 | 3570.020000 | 3584.560000 | 3570.170000 | 3598.730000 | 3598.730000 | 49.790000 | 92.140000 | 138.680000 | 188.680000 | 201.820000 | 260.530000 |

regression_data.loc[(regression_data['RSI Condition']==-1) & (regression_data['Trend']==-1)].describe()

| Close | RSI Condition | MACD Condition | EMA Condition | BB Condition | ATR | Trend | future_price1 | future_price3 | future_price5 | future_price10 | future_price15 | future_price30 | future_price1 P/L | future_price3 P/L | future_price5 P/L | future_price10 P/L | future_price15 P/L | future_price30 P/L | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| mean | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| std | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| min | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 25% | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 50% | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 75% | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| max | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

regression_data.loc[(regression_data['BB Condition']==1)].describe()

| Close | RSI Condition | MACD Condition | EMA Condition | BB Condition | ATR | Trend | future_price1 | future_price3 | future_price5 | future_price10 | future_price15 | future_price30 | future_price1 P/L | future_price3 P/L | future_price5 P/L | future_price10 P/L | future_price15 P/L | future_price30 P/L | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 70.000000 | 70.000000 | 70.000000 | 70.000000 | 70.0 | 70.000000 | 70.000000 | 70.000000 | 70.000000 | 70.000000 | 70.000000 | 70.000000 | 70.000000 | 70.000000 | 70.000000 | 70.000000 | 70.000000 | 70.000000 | 70.000000 |

| mean | 2986.430714 | 0.300000 | 0.000000 | -0.371429 | 1.0 | 35.702044 | 0.000000 | 2987.270857 | 2981.850286 | 2977.725143 | 2983.465143 | 3011.833143 | 3056.373000 | 0.840143 | -4.580429 | -8.705571 | -2.965571 | 25.402429 | 69.942286 |

| std | 311.120339 | 0.461566 | 0.170251 | 0.486675 | 0.0 | 12.624611 | 0.868115 | 311.808179 | 309.626580 | 302.923491 | 311.104642 | 298.080561 | 307.476354 | 39.272759 | 53.538780 | 73.277841 | 132.878205 | 165.010155 | 219.831930 |

| min | 2233.480000 | 0.000000 | -1.000000 | -1.000000 | 1.0 | 21.622012 | -1.000000 | 2233.480000 | 2311.000000 | 2416.240000 | 2233.480000 | 2450.680000 | 2463.290000 | -128.570000 | -110.060000 | -166.230000 | -304.870000 | -326.320000 | -233.890000 |

| 25% | 2797.670000 | 0.000000 | 0.000000 | -1.000000 | 1.0 | 27.047908 | -1.000000 | 2806.167500 | 2771.952500 | 2743.960000 | 2836.035000 | 2867.685000 | 2932.367500 | -17.672500 | -30.270000 | -54.307500 | -79.570000 | -65.617500 | -33.140000 |

| 50% | 3086.225000 | 0.000000 | 0.000000 | 0.000000 | 1.0 | 32.036454 | 0.000000 | 3092.880000 | 3063.995000 | 3068.140000 | 3084.600000 | 3107.265000 | 3143.340000 | -0.135000 | -10.700000 | -14.680000 | -8.180000 | 24.815000 | 34.585000 |

| 75% | 3187.090000 | 1.000000 | 0.000000 | 0.000000 | 1.0 | 40.845653 | 1.000000 | 3193.747500 | 3191.762500 | 3180.460000 | 3197.337500 | 3193.385000 | 3243.512500 | 14.032500 | 21.395000 | 16.362500 | 45.447500 | 84.727500 | 110.515000 |

| max | 3498.200000 | 1.000000 | 1.000000 | 0.000000 | 1.0 | 86.987863 | 1.000000 | 3501.300000 | 3479.760000 | 3466.380000 | 3533.990000 | 3609.240000 | 3517.940000 | 177.260000 | 192.140000 | 262.290000 | 548.890000 | 774.240000 | 929.670000 |

regression_data.loc[(regression_data['BB Condition']==1) & (regression_data['Trend']==1)].describe()

| Close | RSI Condition | MACD Condition | EMA Condition | BB Condition | ATR | Trend | future_price1 | future_price3 | future_price5 | future_price10 | future_price15 | future_price30 | future_price1 P/L | future_price3 P/L | future_price5 P/L | future_price10 P/L | future_price15 P/L | future_price30 P/L | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 26.000000 | 26.000000 | 26.0 | 26.0 | 26.0 | 26.000000 | 26.0 | 26.000000 | 26.0000 | 26.000000 | 26.000000 | 26.000000 | 26.000000 | 26.000000 | 26.000000 | 26.00000 | 26.000000 | 26.000000 | 26.000000 |

| mean | 3251.492692 | 0.192308 | 0.0 | 0.0 | 1.0 | 30.658029 | 1.0 | 3253.615385 | 3247.4100 | 3238.022692 | 3239.091538 | 3257.128077 | 3330.798077 | 2.122692 | -4.082692 | -13.47000 | -12.401154 | 5.635385 | 79.305385 |

| std | 124.961705 | 0.401918 | 0.0 | 0.0 | 0.0 | 7.281805 | 0.0 | 125.233842 | 125.4639 | 119.086056 | 137.790410 | 153.277721 | 117.242815 | 28.132920 | 33.941365 | 43.16825 | 82.448464 | 108.827701 | 115.604817 |

| min | 3056.470000 | 0.000000 | 0.0 | 0.0 | 1.0 | 22.280093 | 1.0 | 3067.520000 | 3056.4700 | 3065.330000 | 3078.360000 | 3087.970000 | 3144.480000 | -65.950000 | -76.200000 | -79.50000 | -115.270000 | -180.810000 | -102.840000 |

| 25% | 3169.877500 | 0.000000 | 0.0 | 0.0 | 1.0 | 26.697141 | 1.0 | 3167.122500 | 3176.3725 | 3161.415000 | 3137.712500 | 3162.112500 | 3235.645000 | -8.892500 | -24.380000 | -40.00250 | -84.280000 | -67.852500 | 18.117500 |

| 50% | 3217.755000 | 0.000000 | 0.0 | 0.0 | 1.0 | 28.519650 | 1.0 | 3216.770000 | 3208.6600 | 3208.620000 | 3207.795000 | 3195.190000 | 3310.725000 | 3.565000 | -12.825000 | -18.36000 | -36.675000 | -2.770000 | 47.855000 |

| 75% | 3317.275000 | 0.000000 | 0.0 | 0.0 | 1.0 | 36.104778 | 1.0 | 3324.332500 | 3319.6775 | 3313.092500 | 3271.207500 | 3327.265000 | 3429.007500 | 12.152500 | 13.107500 | -0.19500 | 45.230000 | 71.205000 | 149.377500 |

| max | 3498.200000 | 1.000000 | 0.0 | 0.0 | 1.0 | 46.020784 | 1.0 | 3501.300000 | 3479.7600 | 3466.380000 | 3533.990000 | 3609.240000 | 3517.940000 | 72.450000 | 88.270000 | 99.65000 | 173.610000 | 214.030000 | 304.450000 |

regression_data.loc[(regression_data['BB Condition']==-1)].describe()

| Close | RSI Condition | MACD Condition | EMA Condition | BB Condition | ATR | Trend | future_price1 | future_price3 | future_price5 | future_price10 | future_price15 | future_price30 | future_price1 P/L | future_price3 P/L | future_price5 P/L | future_price10 P/L | future_price15 P/L | future_price30 P/L | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 61.000000 | 61.000000 | 61.0 | 61.000000 | 61.0 | 61.000000 | 61.000000 | 61.000000 | 61.000000 | 61.000000 | 61.000000 | 61.000000 | 61.000000 | 61.000000 | 61.000000 | 61.000000 | 61.000000 | 61.000000 | 61.000000 |

| mean | 3147.171639 | -0.344262 | 0.0 | 0.672131 | -1.0 | 41.129853 | 0.540984 | 3149.098689 | 3156.505902 | 3161.389344 | 3149.882295 | 3135.338525 | 3144.384426 | 1.927049 | 9.334262 | 14.217705 | 2.710656 | -11.833115 | -2.787213 |

| std | 251.206177 | 0.479070 | 0.0 | 0.473333 | 0.0 | 23.673062 | 0.720504 | 252.122987 | 258.603112 | 267.813808 | 274.422449 | 281.319024 | 282.963494 | 30.517524 | 59.343061 | 92.213283 | 131.787919 | 156.868024 | 166.199884 |

| min | 2531.790000 | -1.000000 | 0.0 | 0.000000 | -1.0 | 18.973271 | -1.000000 | 2538.550000 | 2527.920000 | 2519.810000 | 2499.830000 | 2484.910000 | 2518.160000 | -73.010000 | -114.630000 | -246.110000 | -297.140000 | -394.410000 | -323.980000 |

| 25% | 3017.150000 | -1.000000 | 0.0 | 0.000000 | -1.0 | 27.563405 | 0.000000 | 3018.270000 | 3018.270000 | 3025.030000 | 3082.960000 | 3068.150000 | 3078.360000 | -16.530000 | -31.110000 | -34.390000 | -66.080000 | -100.360000 | -101.790000 |

| 50% | 3203.930000 | 0.000000 | 0.0 | 1.000000 | -1.0 | 36.124680 | 1.000000 | 3207.360000 | 3209.790000 | 3236.260000 | 3181.030000 | 3176.570000 | 3198.650000 | 2.800000 | 6.030000 | 4.670000 | 1.560000 | -44.810000 | -36.640000 |

| 75% | 3300.750000 | 0.000000 | 0.0 | 1.000000 | -1.0 | 44.185695 | 1.000000 | 3300.750000 | 3346.390000 | 3362.430000 | 3348.640000 | 3329.460000 | 3254.770000 | 17.880000 | 40.830000 | 67.690000 | 64.120000 | 58.700000 | 89.260000 |

| max | 3615.280000 | 0.000000 | 0.0 | 1.000000 | -1.0 | 119.844777 | 1.000000 | 3613.930000 | 3570.020000 | 3584.560000 | 3518.480000 | 3548.230000 | 3615.280000 | 105.080000 | 185.730000 | 339.630000 | 433.060000 | 520.040000 | 492.040000 |

regression_data.loc[(regression_data['BB Condition']==-1) & (regression_data['Trend']==-1)].describe()

| Close | RSI Condition | MACD Condition | EMA Condition | BB Condition | ATR | Trend | future_price1 | future_price3 | future_price5 | future_price10 | future_price15 | future_price30 | future_price1 P/L | future_price3 P/L | future_price5 P/L | future_price10 P/L | future_price15 P/L | future_price30 P/L | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 8.000000 | 8.0 | 8.0 | 8.0 | 8.0 | 8.000000 | 8.0 | 8.000000 | 8.000000 | 8.000000 | 8.000000 | 8.000000 | 8.000000 | 8.000000 | 8.000000 | 8.000000 | 8.000000 | 8.000000 | 8.000000 |

| mean | 2821.693750 | 0.0 | 0.0 | 0.0 | -1.0 | 32.003612 | -1.0 | 2819.261250 | 2794.926250 | 2798.562500 | 2778.227500 | 2755.513750 | 2799.190000 | -2.432500 | -26.767500 | -23.131250 | -43.466250 | -66.180000 | -22.503750 |

| std | 296.580805 | 0.0 | 0.0 | 0.0 | 0.0 | 10.787601 | 0.0 | 312.146218 | 303.083263 | 307.656373 | 280.359568 | 284.648733 | 271.893036 | 27.369196 | 55.968789 | 76.451593 | 96.898914 | 150.985435 | 151.998573 |

| min | 2531.790000 | 0.0 | 0.0 | 0.0 | -1.0 | 18.973271 | -1.0 | 2538.550000 | 2527.920000 | 2519.810000 | 2527.920000 | 2484.910000 | 2567.650000 | -42.850000 | -114.630000 | -113.080000 | -186.630000 | -394.410000 | -323.980000 |

| 25% | 2554.257500 | 0.0 | 0.0 | 0.0 | -1.0 | 23.159769 | -1.0 | 2539.607500 | 2537.850000 | 2539.732500 | 2556.817500 | 2546.705000 | 2605.750000 | -23.507500 | -52.432500 | -66.807500 | -123.152500 | -113.095000 | -98.430000 |

| 50% | 2743.800000 | 0.0 | 0.0 | 0.0 | -1.0 | 31.127838 | -1.0 | 2705.990000 | 2661.255000 | 2670.820000 | 2643.985000 | 2612.710000 | 2641.050000 | 3.380000 | -34.710000 | -36.710000 | -13.940000 | -25.430000 | 27.245000 |

| 75% | 3137.590000 | 0.0 | 0.0 | 0.0 | -1.0 | 42.536336 | -1.0 | 3166.897500 | 3111.482500 | 3091.420000 | 3029.905000 | 3045.792500 | 3043.057500 | 14.610000 | -0.052500 | 2.620000 | 2.372500 | 36.382500 | 94.630000 |

| max | 3167.790000 | 0.0 | 0.0 | 0.0 | -1.0 | 45.486099 | -1.0 | 3190.620000 | 3209.790000 | 3267.400000 | 3239.100000 | 3176.570000 | 3243.920000 | 35.120000 | 78.310000 | 135.920000 | 107.620000 | 64.180000 | 112.440000 |

import pandas as pd

btc_df = pd.read_csv('BTC-USD.csv')

bnb_df = pd.read_csv('BNB-USD.csv')

doge_df = pd.read_csv('DOGE-USD.csv')

sol_df = pd.read_csv('SOL1-USD.csv')

ada_df = pd.read_csv('ADA-USD.csv')

xrp_df = pd.read_csv('XRP-USD.csv')

eth_df = pd.read_csv('ETH-USD.csv')

oil_df = pd.read_excel('Oil.xlsx')

gold_df = pd.read_csv('Gold.csv')

sp500_df = pd.read_csv('SP500.csv')

sti_df = pd.read_csv('STI.csv')

btc_hourly_df = btc_df = pd.read_csv('reddit_bitcoin_1h.csv')

oil_df

oil_df = oil_df[pd.to_numeric(oil_df['Close'], errors='coerce').notnull()]

oil_df = oil_df[pd.to_numeric(oil_df['Low'], errors='coerce').notnull()]

oil_df = oil_df[pd.to_numeric(oil_df['High'], errors='coerce').notnull()]

oil_df = oil_df[pd.to_numeric(oil_df['Volume'], errors='coerce').notnull()]

for column in oil_df.columns:

try:

oil_df[column] = pd.to_numeric(oil_df[column])

except:

pass

oil_df.reset_index(inplace=True)

for column in gold_df.columns:

gold_df[column] = gold_df[column].str.replace(r',', '')

gold_df = gold_df[pd.to_numeric(gold_df['Close'], errors='coerce').notnull()]

gold_df = gold_df[pd.to_numeric(gold_df['Low'], errors='coerce').notnull()]

gold_df = gold_df[pd.to_numeric(gold_df['High'], errors='coerce').notnull()]

gold_df = gold_df[pd.to_numeric(gold_df['Volume'], errors='coerce').notnull()]

for column in gold_df.columns:

try:

gold_df[column] = pd.to_numeric(gold_df[column])

except:

pass

gold_df.reset_index(inplace=True)

for column in sp500_df.columns:

sp500_df[column] = sp500_df[column].str.replace(r',', '')

sp500_df = sp500_df[pd.to_numeric(sp500_df['Close'], errors='coerce').notnull()]

sp500_df = sp500_df[pd.to_numeric(sp500_df['Low'], errors='coerce').notnull()]

sp500_df = sp500_df[pd.to_numeric(sp500_df['High'], errors='coerce').notnull()]

sp500_df = sp500_df[pd.to_numeric(sp500_df['Volume'], errors='coerce').notnull()]

for column in sp500_df.columns:

try:

sp500_df[column] = pd.to_numeric(sp500_df[column])

except:

pass

sp500_df.reset_index(inplace=True)

sti_df

| Date | Open | High | Low | Close | Volume | |

|---|---|---|---|---|---|---|

| 0 | 1987-12-28 | 824.40 | 824.40 | 824.40 | 824.40 | NaN |

| 1 | 1987-12-29 | 810.90 | 810.90 | 810.90 | 810.90 | NaN |

| 2 | 1987-12-30 | 823.20 | 823.20 | 823.20 | 823.20 | NaN |

| 3 | 1988-01-04 | 833.60 | 833.60 | 833.60 | 833.60 | NaN |

| 4 | 1988-01-05 | 879.30 | 879.30 | 879.30 | 879.30 | NaN |

| ... | ... | ... | ... | ... | ... | ... |

| 8453 | 2021-11-03 | 3234.28 | 3236.86 | 3216.86 | 3219.69 | 204587761.0 |

| 8454 | 2021-11-05 | 3234.41 | 3248.07 | 3225.16 | 3242.34 | 279049200.0 |

| 8455 | 2021-11-08 | 3251.85 | 3270.65 | 3250.39 | 3263.90 | 319638000.0 |

| 8456 | 2021-11-09 | 3267.92 | 3273.54 | 3239.71 | 3243.42 | 332843200.0 |

| 8457 | 2021-11-10 | 3245.19 | 3246.00 | 3218.31 | 3231.32 | NaN |

8458 rows × 6 columns

#input df containing 'Date', 'Open', 'High', 'Low', 'Close', 'Adj Close', 'Volume'\

#output TA regression data

import talib

import numpy as np

def generate_regression_data(df):

rsi = talib.RSI(df['Close'], timeperiod=14)

d = {'Date': df['Date'], ' RSI': rsi}

rsi_df = pd.DataFrame(data=d)

rsi_df['RSI Condition'] = rsi_df[' RSI'].copy()

rsi_df.loc[rsi_df['RSI Condition'] <= 30, 'RSI Condition'] = 1

rsi_df.loc[(rsi_df['RSI Condition'] > 30) & (rsi_df['RSI Condition'] < 70), 'RSI Condition'] = 0

rsi_df.loc[rsi_df['RSI Condition'] >= 70, 'RSI Condition'] = -1

macd, macdsignal, macdhist = talib.MACD(df['Close'], fastperiod=12, slowperiod=26, signalperiod=9)

d = {'Date': df['Date'], ' MACD': macd, ' MACD_SIG': macdsignal}

macd_df = pd.DataFrame(data=d)

macd_df['MACD Condition'] = 0

for df_entry in range(len(macd_df)-1):

#MACD crossing MACD_SIGNAL from above

if macd_df[' MACD'][df_entry] > macd_df[' MACD_SIG'][df_entry] and macd_df[' MACD'][df_entry+1] < macd_df[' MACD_SIG'][df_entry+1]:

macd_df['MACD Condition'][df_entry] = -1

#print(macd_df[' MACD'][df_entry],macd_df[' MACD_SIG'][df_entry],macd_df[' MACD'][df_entry+1],macd_df[' MACD_SIG'][df_entry+1])

#MACD crossing MACD_SIGNAL from below

if macd_df[' MACD'][df_entry] < macd_df[' MACD_SIG'][df_entry] and macd_df[' MACD'][df_entry+1] > macd_df[' MACD_SIG'][df_entry+1]:

macd_df['MACD Condition'][df_entry] = 1

#print(macd_df[' MACD'][df_entry],macd_df[' MACD_SIG'][df_entry],macd_df[' MACD'][df_entry+1],macd_df[' MACD_SIG'][df_entry+1])

ema5 = talib.EMA(df['Close'], timeperiod=5)

ema25 = talib.EMA(df['Close'], timeperiod=25)

ema50 = talib.EMA(df['Close'], timeperiod=50)

ema100 = talib.EMA(df['Close'], timeperiod=100)

ema200 = talib.EMA(df['Close'], timeperiod=200)

d = {'Date': df['Date'],' EMA5': ema5, ' EMA25': ema25, ' EMA50': ema50,' EMA100': ema100, ' EMA200': ema200, }

ema_df = pd.DataFrame(data=d)

ema_df['Close'] = df['Close']

ema_df['EMA Condition'] = 0

#used with the EMA25 to prevent trend trades too far from the EMA - likely trend reversal back to the EMA

ema25std = ema_df[' EMA25'].std()*0.33

ema_df.loc[(ema_df['Close'] > ema_df[' EMA5']) & (ema_df['Close'] > ema_df[' EMA25']) & (ema_df['Close'] > ema_df[' EMA50']) & (ema_df['Close'] > ema_df[' EMA100']) & (ema_df['Close'] > ema_df[' EMA200']), 'EMA Condition'] = 1

ema_df.loc[(ema_df['Close'] < ema_df[' EMA5']) & (ema_df['Close'] < ema_df[' EMA25']) & (ema_df['Close'] < ema_df[' EMA50']) & (ema_df['Close'] < ema_df[' EMA100']) & (ema_df['Close'] < ema_df[' EMA200']), 'EMA Condition'] = -1

ema_df['Trend'] = 0

ema_df.loc[ema_df[' EMA200'] < ema_df['Close'], 'Trend'] = 1

ema_df.loc[ema_df[' EMA200'] > ema_df['Close'], 'Trend'] = -1

ema_df['Close-EMA200 Price Diff'] = ema_df['Close'] - ema_df[' EMA200']

atr = talib.ATR(df['High'], df['Low'], df['Close'], timeperiod=14)

d = {'Date': df['Date'], ' ATR': atr }

atr_df = pd.DataFrame(data=d)

atr_df['Close'] = df['Close']

bb_upperband, bb_middleband, bb_lowerband = talib.BBANDS(df['Close'], timeperiod=20, nbdevup=2, nbdevdn=2, matype=0)

d = {'Date': df['Date'], ' Upper BB': bb_upperband,' Middle BB': bb_middleband, ' Lower BB': bb_lowerband,}

bb_df = pd.DataFrame(data=d)

bb_df['Close'] = df['Close']

bb_df['BB Condition'] = 0

bb_df.loc[(bb_df['Close'] > bb_df[' Upper BB']), 'BB Condition'] = -1

bb_df.loc[(bb_df['Close'] < bb_df[' Lower BB']), 'BB Condition'] = 1

# Windowed regression based regressors

forecasted = talib.TSF(df['Close'], timeperiod=14)

d = {'Date': df['Date'], 'Close': df['Close'],'Forecasted': forecasted}

forecasted_df = pd.DataFrame(data=d)

slope = talib.LINEARREG_SLOPE(df['Close'], timeperiod=14)

d = {'Date': df['Date'], 'Close': df['Close'], 'Slope': slope}

slope_df = pd.DataFrame(data=d)

acceleration = talib.LINEARREG_SLOPE(slope_df['Slope'], timeperiod=14)

d = {'Date': df['Date'], 'Close': df['Close'],'Acceleration': acceleration}

acceleration_df = pd.DataFrame(data=d)

# Merge all datafraems

rsi_cols_to_use = rsi_df.columns.difference(bb_df.columns)

ema_cols_to_use = ema_df.columns.difference(bb_df.columns)

atr_cols_to_use = atr_df.columns.difference(bb_df.columns)

macd_cols_to_use = macd_df.columns.difference(bb_df.columns)

forecasted_cols_to_use = forecasted_df.columns.difference(bb_df.columns)

slope_cols_to_use = slope_df.columns.difference(bb_df.columns)

acceleration_cols_to_use = acceleration_df.columns.difference(bb_df.columns)

result = pd.concat([rsi_df[rsi_cols_to_use],macd_df[macd_cols_to_use],ema_df[ema_cols_to_use],

atr_df[atr_cols_to_use],forecasted_df[forecasted_cols_to_use], bb_df,

slope_df[slope_cols_to_use], acceleration_df[acceleration_cols_to_use]],axis=1)

result['Volume'] = df['Volume']

# Volume is partially related to price, and effect can be slightly corrected by making it relative to price

result['Price Relative Volume'] = result['Volume']/result['Close']

# Volatility should be relative to price

result['Price Relative ATR'] = result[' ATR']/result['Close']*100

result['Price Relative Close-EMA200 Price Diff'] = result['Close-EMA200 Price Diff']/result['Close']

result['Forecasted % Profit'] = (result['Forecasted'] - result['Close'])/result['Close']

# Price corrected volume can then be logged to control for decreased marginal effects

result['Log Price Relative Volume'] = np.log(result['Price Relative Volume'])

# Price corrected ATR can then be logged to control for decreased marginal effects

result['Log Price Relative ATR'] = np.log(result['Price Relative ATR'])

result['Price Diff Sign'] = 0

result.loc[result['Price Relative Close-EMA200 Price Diff']<0,'Price Diff Sign'] = -1

result.loc[result['Price Relative Close-EMA200 Price Diff']>0,'Price Diff Sign'] = 1

result['Log(Price Relative Close-EMA200 Price Diff)'] = np.log(np.sqrt((result['Price Relative Close-EMA200 Price Diff'])**2+1))*result['Price Diff Sign']

result['Log(Price Relative Volume)'] = np.log(result['Price Relative Volume'])

result['Log(Price Relative ATR)'] = np.log(result['Price Relative ATR'])

result['RSI x Trend'] = result[' RSI'] * result['Trend']

result['RSI x Price Relative Close-EMA200 Price Diff'] = result[' RSI'] * result['Price Relative Close-EMA200 Price Diff']

result['RSI Condition x Trend'] = result['RSI Condition'] * result['Trend']

result['RSI Condition x Price Relative Close-EMA200 Price Diff'] = result['RSI Condition'] * result['Price Relative Close-EMA200 Price Diff']

result['MACD Condition x Trend'] = result['MACD Condition'] * result['Trend']

result['MACD Condition x Price Relative Close-EMA200 Price Diff'] = result['MACD Condition'] * result['Price Relative Close-EMA200 Price Diff']

regression_data = result[['Date','Close', 'Volume',' RSI', 'RSI Condition', 'MACD Condition',

'EMA Condition','Close-EMA200 Price Diff', 'BB Condition', ' ATR', 'Trend',

'Forecasted', 'Slope', 'Acceleration','Price Relative Close-EMA200 Price Diff','Price Relative ATR',

]]

future_price_dict = dict()

for future in [1,3,5,10,15,30]:

future_price_dict['future_price'+str(future)] = list(regression_data['Close'])[future:] + [np.NaN for i in range(future)]

for future_price in future_price_dict:

regression_data[future_price] = future_price_dict[future_price]

for future_price in future_price_dict:

regression_data[future_price + ' P/L'] = regression_data[future_price] - regression_data['Close']

regression_data[future_price + ' % P/L'] = (regression_data[future_price] - regression_data['Close'])/regression_data['Close']

regression_data.dropna(inplace= True)

return(regression_data)

btc_regression_data = generate_regression_data(btc_df)

oil_regression_data = generate_regression_data(oil_df)

gold_regression_data = generate_regression_data(gold_df)

sp500_regression_data = generate_regression_data(sp500_df)

sti_regression_data = generate_regression_data(sti_df)

btc_hourly_df

| Date | Open | High | Low | Close | Volume | |

|---|---|---|---|---|---|---|

| 0 | 1/1/2015 | 4053 | 4053 | 4053 | 4053 | 1082572 |

| 1 | 2/1/2015 | 4053 | 5164 | 4006 | 4103 | 1082610 |

| 2 | 3/1/2015 | 4103 | 4935 | 4056 | 4935 | 1082642 |

| 3 | 4/1/2015 | 4935 | 5247 | 4226 | 4249 | 1082694 |

| 4 | 5/1/2015 | 4249 | 5335 | 4126 | 4137 | 1082745 |

| ... | ... | ... | ... | ... | ... | ... |

| 2778 | 10/8/2022 | 3398 | 3514 | 2375 | 2613 | 1184552 |

| 2779 | 11/8/2022 | 2613 | 2990 | 2471 | 2601 | 1184602 |

| 2780 | 12/8/2022 | 2601 | 4041 | 2473 | 2697 | 1184634 |

| 2781 | 13/8/2022 | 2697 | 4377 | 2697 | 3470 | 1184650 |

| 2782 | 14/8/2022 | 3470 | 4793 | 3121 | 3161 | 1184669 |

2783 rows × 6 columns

btc_hourly_regression = generate_regression_data(btc_hourly_df)

bnb_df_regression_data = generate_regression_data(bnb_df)

doge_df_regression_data = generate_regression_data(doge_df)

sol_df_regression_data = generate_regression_data(sol_df)

ada_df_regression_data = generate_regression_data(ada_df)

xrp_df_regression_data = generate_regression_data(xrp_df)

eth_df_regression_data = generate_regression_data(eth_df)

btc_regression_data.to_csv('BTC Regression Data.csv')

oil_regression_data.to_csv('Oil Regression Data.csv')

gold_regression_data.to_csv('Gold Regression Data.csv')

sp500_regression_data.to_csv('SP500 Regression Data.csv')

sti_regression_data.to_csv('STI Regression Data.csv')

bnb_df_regression_data.to_csv('BNB Regression Data.csv')

doge_df_regression_data.to_csv('DOGE Regression Data.csv')

sol_df_regression_data.to_csv('SOL Regression Data.csv')

ada_df_regression_data.to_csv('ADA Regression Data.csv')

xrp_df_regression_data.to_csv('XRP Regression Data.csv')

eth_df_regression_data.to_csv('ETH Regression Data.csv')

btc_regression_data.loc[(btc_regression_data['MACD Condition']==1) & (btc_regression_data['Trend']==1)].describe()

| Close | Volume | RSI | RSI Condition | MACD Condition | EMA Condition | Close-EMA200 Price Diff | BB Condition | ATR | Trend | ... | future_price3 P/L | future_price3 % P/L | future_price5 P/L | future_price5 % P/L | future_price10 P/L | future_price10 % P/L | future_price15 P/L | future_price15 % P/L | future_price30 P/L | future_price30 % P/L | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 32.000000 | 3.200000e+01 | 32.000000 | 32.000000 | 32.0 | 32.000000 | 32.000000 | 32.000000 | 32.000000 | 32.0 | ... | 32.000000 | 32.000000 | 32.000000 | 32.000000 | 32.000000 | 32.000000 | 32.000000 | 32.000000 | 32.000000 | 32.000000 |

| mean | 4008.877690 | 6.264674e+09 | 57.447237 | -0.062500 | 1.0 | 0.750000 | 1198.619438 | -0.062500 | 234.856549 | 1.0 | ... | 51.972857 | 0.033109 | 40.089586 | 0.041386 | 107.969098 | 0.069483 | 119.937623 | 0.084667 | 454.422790 | 0.174932 |

| std | 4530.571752 | 9.783652e+09 | 10.045499 | 0.245935 | 0.0 | 0.439941 | 1907.217346 | 0.245935 | 380.113580 | 0.0 | ... | 588.652397 | 0.070953 | 799.965292 | 0.096019 | 1233.418409 | 0.142010 | 1337.147609 | 0.160539 | 2892.189093 | 0.352368 |

| min | 293.623993 | 3.059200e+07 | 39.035522 | -1.000000 | 1.0 | 0.000000 | 23.184583 | -1.000000 | 4.845750 | 1.0 | ... | -2259.400391 | -0.132798 | -2955.549805 | -0.250761 | -4165.000000 | -0.353376 | -4530.299805 | -0.259921 | -9152.490234 | -0.525115 |

| 25% | 585.029022 | 5.999460e+07 | 51.167565 | 0.000000 | 1.0 | 0.750000 | 57.837228 | 0.000000 | 12.622950 | 1.0 | ... | 1.175255 | 0.002166 | 3.317490 | 0.006163 | 3.753242 | 0.005551 | -5.878281 | -0.002678 | -17.090798 | -0.002641 |

| 50% | 1040.425049 | 2.307740e+08 | 59.961742 | 0.000000 | 1.0 | 1.000000 | 223.330091 | 0.000000 | 54.426280 | 1.0 | ... | 23.459503 | 0.025814 | 61.738998 | 0.022342 | 50.430115 | 0.075629 | 61.507004 | 0.066150 | 45.614990 | 0.104992 |

| 75% | 7916.903442 | 1.055410e+10 | 65.083361 | 0.000000 | 1.0 | 1.000000 | 1999.167047 | 0.000000 | 293.940517 | 1.0 | ... | 233.744324 | 0.064248 | 303.356506 | 0.103796 | 477.322570 | 0.159274 | 286.520935 | 0.205025 | 232.644233 | 0.277055 |

| max | 17429.500000 | 2.989318e+10 | 75.897147 | 0.000000 | 1.0 | 1.000000 | 9545.651620 | 0.000000 | 1702.536466 | 1.0 | ... | 947.970215 | 0.236071 | 1249.420410 | 0.211764 | 2317.269531 | 0.354806 | 3265.538086 | 0.394313 | 11625.710450 | 1.476901 |

8 rows × 33 columns

btc_regression_data.loc[(btc_regression_data['MACD Condition']==-1) & (btc_regression_data['Trend']==-1)].describe()

| Close | Volume | RSI | RSI Condition | MACD Condition | EMA Condition | Close-EMA200 Price Diff | BB Condition | ATR | Trend | ... | future_price3 P/L | future_price3 % P/L | future_price5 P/L | future_price5 % P/L | future_price10 P/L | future_price10 % P/L | future_price15 P/L | future_price15 % P/L | future_price30 P/L | future_price30 % P/L | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 18.000000 | 1.800000e+01 | 18.000000 | 18.000000 | 18.0 | 18.000000 | 18.000000 | 18.000000 | 18.000000 | 18.0 | ... | 18.000000 | 18.000000 | 18.000000 | 18.000000 | 18.000000 | 18.000000 | 18.000000 | 18.000000 | 18.000000 | 18.000000 |

| mean | 4955.405020 | 6.425943e+09 | 43.008671 | 0.166667 | -1.0 | -0.611111 | -1041.054754 | 0.166667 | 187.523029 | -1.0 | ... | -94.266882 | -0.018582 | -112.793791 | -0.022014 | -142.534587 | -0.022471 | -108.652961 | -0.007967 | -87.194437 | 0.005086 |

| std | 2653.460727 | 5.945564e+09 | 9.739398 | 0.383482 | 0.0 | 0.501631 | 788.013232 | 0.383482 | 156.756870 | 0.0 | ... | 562.411220 | 0.078433 | 604.386099 | 0.084543 | 856.929989 | 0.129672 | 959.132313 | 0.155424 | 1159.337266 | 0.192402 |

| min | 236.802002 | 1.113430e+07 | 26.108776 | 0.000000 | -1.0 | -1.000000 | -2966.615892 | 0.000000 | 4.139630 | -1.0 | ... | -1043.700196 | -0.127135 | -1235.870606 | -0.150543 | -2005.330079 | -0.314746 | -2550.550049 | -0.400321 | -2884.319825 | -0.452707 |

| 25% | 3560.557496 | 3.593760e+09 | 39.145753 | 0.000000 | -1.0 | -1.000000 | -1603.517074 | 0.000000 | 86.066374 | -1.0 | ... | -334.422241 | -0.056195 | -299.072388 | -0.074687 | -225.281983 | -0.069916 | -113.650024 | -0.052682 | -213.548095 | -0.030023 |

| 50% | 6428.830079 | 5.405500e+09 | 42.429902 | 0.000000 | -1.0 | -1.000000 | -982.901602 | 0.000000 | 157.699586 | -1.0 | ... | -88.358520 | -0.034405 | -68.869751 | -0.025324 | -10.729981 | -0.008233 | -11.218002 | -0.017168 | 13.004006 | 0.029656 |

| 75% | 6771.950074 | 6.635868e+09 | 49.745035 | 0.000000 | -1.0 | 0.000000 | -651.448766 | 0.000000 | 264.541367 | -1.0 | ... | 9.329758 | -0.000336 | 9.144192 | 0.006603 | 95.137268 | 0.023550 | 247.284057 | 0.036129 | 414.868408 | 0.088411 |

| max | 8209.400391 | 2.194288e+10 | 59.848159 | 1.000000 | -1.0 | 0.000000 | -41.819634 | 1.000000 | 647.709040 | -1.0 | ... | 1730.300781 | 0.230256 | 1741.476563 | 0.231744 | 1810.045898 | 0.240868 | 1752.889648 | 0.288186 | 1874.530273 | 0.337859 |

8 rows × 33 columns

btc_regression_data.loc[(btc_regression_data['RSI Condition']==1) & (btc_regression_data['Trend']==1)].describe()

| Close | Volume | RSI | RSI Condition | MACD Condition | EMA Condition | Close-EMA200 Price Diff | BB Condition | ATR | Trend | ... | future_price3 P/L | future_price3 % P/L | future_price5 P/L | future_price5 % P/L | future_price10 P/L | future_price10 % P/L | future_price15 P/L | future_price15 % P/L | future_price30 P/L | future_price30 % P/L | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 5.000000 | 5.000000e+00 | 5.000000 | 5.0 | 5.0 | 5.0 | 5.000000 | 5.0 | 5.000000 | 5.0 | ... | 5.000000 | 5.000000 | 5.000000 | 5.000000 | 5.000000 | 5.000000 | 5.000000 | 5.000000 | 5.000000 | 5.000000 |

| mean | 1599.085181 | 1.075414e+09 | 26.866047 | 1.0 | 0.0 | 0.0 | 213.828033 | 1.0 | 131.972490 | 1.0 | ... | 228.394965 | 0.117370 | 485.564838 | 0.254419 | 354.525830 | 0.183088 | 550.326990 | 0.254824 | 1464.591437 | 0.668475 |

| std | 1153.304319 | 1.014302e+09 | 1.875510 | 0.0 | 0.0 | 0.0 | 203.433908 | 0.0 | 121.257148 | 0.0 | ... | 189.779714 | 0.057709 | 398.160044 | 0.141672 | 294.017088 | 0.113423 | 492.930312 | 0.203150 | 1315.895308 | 0.551777 |

| min | 364.330994 | 1.533510e+08 | 23.805647 | 1.0 | 0.0 | 0.0 | 24.670983 | 1.0 | 16.188372 | 1.0 | ... | 22.837005 | 0.050374 | 45.224975 | 0.082608 | 27.395019 | 0.073236 | 13.924011 | 0.038218 | 24.837952 | 0.045369 |

| 25% | 547.465027 | 3.309330e+08 | 26.569021 | 1.0 | 0.0 | 0.0 | 27.744906 | 1.0 | 21.117980 | 1.0 | ... | 27.578003 | 0.062682 | 55.899017 | 0.153429 | 40.093994 | 0.075193 | 25.750976 | 0.047037 | 42.899017 | 0.117747 |

| 50% | 1929.819946 | 9.936080e+08 | 27.229018 | 1.0 | 0.0 | 0.0 | 216.063673 | 1.0 | 153.683627 | 1.0 | ... | 320.019898 | 0.135638 | 737.940064 | 0.244067 | 527.890137 | 0.167321 | 758.319947 | 0.319536 | 2252.110230 | 0.848457 |

| 75% | 1998.859985 | 1.182870e+09 | 28.343900 | 1.0 | 0.0 | 0.0 | 287.275206 | 1.0 | 158.116224 | 1.0 | ... | 343.609986 | 0.160101 | 770.020020 | 0.382388 | 577.619995 | 0.288975 | 945.520142 | 0.379376 | 2326.269898 | 1.163798 |

| max | 3154.949951 | 2.716310e+09 | 28.382649 | 1.0 | 0.0 | 0.0 | 513.385397 | 1.0 | 310.756245 | 1.0 | ... | 427.929932 | 0.178053 | 818.740113 | 0.409604 | 599.630005 | 0.310718 | 1008.119873 | 0.489953 | 2676.840088 | 1.167005 |

8 rows × 33 columns

btc_regression_data.loc[(btc_regression_data['RSI Condition']==-1) & (btc_regression_data['Trend']==-1)].describe()

| Close | Volume | RSI | RSI Condition | MACD Condition | EMA Condition | Close-EMA200 Price Diff | BB Condition | ATR | Trend | ... | future_price3 P/L | future_price3 % P/L | future_price5 P/L | future_price5 % P/L | future_price10 P/L | future_price10 % P/L | future_price15 P/L | future_price15 % P/L | future_price30 P/L | future_price30 % P/L | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 10.000000 | 1.000000e+01 | 10.000000 | 10.0 | 10.0 | 10.0 | 10.000000 | 10.000000 | 10.000000 | 10.0 | ... | 10.000000 | 10.000000 | 10.000000 | 10.000000 | 10.000000 | 10.000000 | 10.000000 | 10.000000 | 10.000000 | 10.000000 |

| mean | 2507.265637 | 4.069447e+09 | 71.876849 | -1.0 | 0.0 | 0.0 | -408.318536 | -0.800000 | 62.866431 | -1.0 | ... | 1.577239 | -0.007711 | -20.494342 | -0.007223 | -81.140655 | -0.001887 | -120.498265 | 0.024721 | -120.432251 | 0.055084 |

| std | 2618.338700 | 4.420388e+09 | 1.866423 | 0.0 | 0.0 | 0.0 | 476.647104 | 0.421637 | 79.704864 | 0.0 | ... | 141.378076 | 0.034063 | 201.835466 | 0.044251 | 106.659095 | 0.058016 | 303.048628 | 0.108544 | 432.629598 | 0.126253 |

| min | 249.007004 | 2.522350e+07 | 70.159186 | -1.0 | 0.0 | 0.0 | -1050.347793 | -1.000000 | 4.104796 | -1.0 | ... | -288.168945 | -0.069564 | -287.741455 | -0.069460 | -246.151855 | -0.060908 | -957.989746 | -0.124235 | -1334.399902 | -0.173049 |

| 25% | 251.751255 | 4.217360e+07 | 70.446502 | -1.0 | 0.0 | 0.0 | -925.735403 | -1.000000 | 4.951041 | -1.0 | ... | -6.624244 | -0.025470 | -131.781311 | -0.033289 | -141.821350 | -0.032665 | -77.040100 | -0.019297 | 18.518128 | 0.004625 |

| 50% | 2105.083237 | 2.588507e+09 | 71.021277 | -1.0 | 0.0 | 0.0 | -109.624556 | -1.000000 | 44.152073 | -1.0 | ... | -4.567498 | -0.018334 | -5.831001 | -0.023312 | -47.405876 | -0.020420 | -18.042442 | 0.007022 | 25.271996 | 0.057267 |

| 75% | 4004.100097 | 8.476662e+09 | 73.074716 | -1.0 | 0.0 | 0.0 | -20.305267 | -1.000000 | 86.684132 | -1.0 | ... | 45.654846 | 0.025297 | 6.057254 | 0.022905 | 1.280505 | 0.005137 | 7.626747 | 0.030454 | 29.439487 | 0.107288 |

| max | 7711.109863 | 9.933627e+09 | 75.720923 | -1.0 | 0.0 | 0.0 | -0.923997 | 0.000000 | 257.879984 | -1.0 | ... | 240.470215 | 0.035678 | 481.040528 | 0.062383 | 29.359986 | 0.115445 | 73.695008 | 0.289773 | 82.232422 | 0.309004 |

8 rows × 33 columns

btc_regression_data.loc[(btc_regression_data['RSI Condition']==1)].describe()

| Close | Volume | RSI | RSI Condition | MACD Condition | EMA Condition | Close-EMA200 Price Diff | BB Condition | ATR | Trend | ... | future_price3 P/L | future_price3 % P/L | future_price5 P/L | future_price5 % P/L | future_price10 P/L | future_price10 % P/L | future_price15 P/L | future_price15 % P/L | future_price30 P/L | future_price30 % P/L | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 68.000000 | 6.800000e+01 | 68.000000 | 68.0 | 68.000000 | 68.000000 | 68.000000 | 68.000000 | 68.000000 | 68.000000 | ... | 68.000000 | 68.000000 | 68.000000 | 68.000000 | 68.000000 | 68.000000 | 68.000000 | 68.000000 | 68.000000 | 68.000000 |